An article by

Andreas Wegmann

Published on

15/07/2022

Updated on

03/11/2023

Reading time

2 min

In an online survey of consumers, ibi research asked numerous questions about purchasing behaviour and banking. One interesting question was who is trusted.

The data basis

The validity of an online survey is distorted in that the respondents are obviously familiar with the use of modern media. Likewise, the willingness to participate in a survey is not evenly distributed among all population groups and social classes. A more realistic picture could only be gained with a compulsory survey, which would certainly meet with high rejection.

The validity of an online survey is distorted in that the respondents are obviously familiar with the use of modern media. Likewise, the willingness to participate in a survey is not evenly distributed among all population groups and social classes. A more realistic picture could only be gained with a compulsory survey, which would certainly meet with high rejection.

The present study is therefore of course based on a voluntary survey and of course in compliance with data protection regulations.

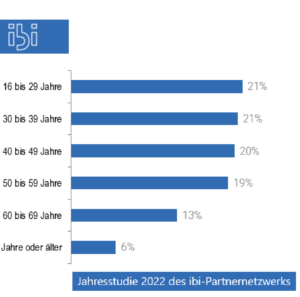

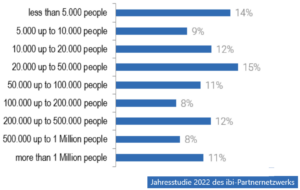

1015 people aged 16 to over 70 from different regions in Germany were interviewed. All federal states were included according to their approximate share in the total population, and attention was also paid to the correct distribution of urban and rural population.

56% of the interviewees had a high school-leaving certificate (Abitur or Fachhochschulreife). Only 1% had no school-leaving qualification.

The monthly net household income was between 2,000 and 3,000 euros for 25%. For 50% it was higher.

Who is trusted for banking?

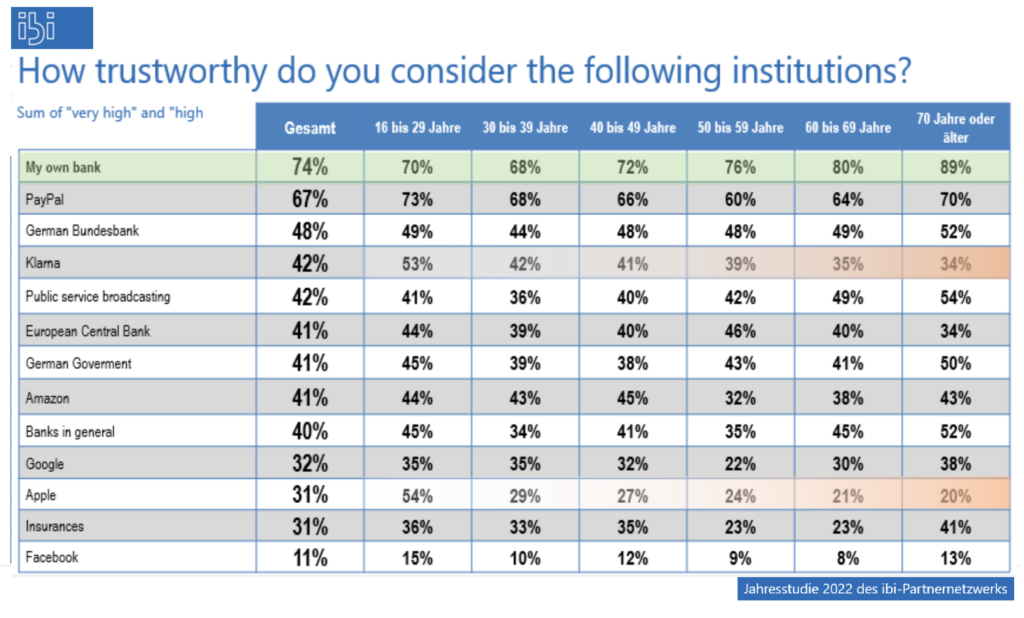

The answer to the question of who is trusted most is clear: one’s own bank!

Trust in one’s own bank is significantly higher than in banks in general. Even the Bundesbank and the ECB are far behind. It is also striking how differently the age groups rate Klarna and Apple, for example. However, Apple is certainly not only assessed in terms of banking.

Trust in one’s own bank is significantly higher than in banks in general. Even the Bundesbank and the ECB are far behind. It is also striking how differently the age groups rate Klarna and Apple, for example. However, Apple is certainly not only assessed in terms of banking.

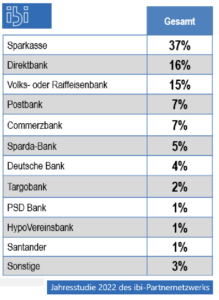

So if the house bank enjoys the highest level of trust, the question arises as to which one it is. In response to the question “At which bank do you have your mainly used current account?” most respondents named the savings banks. The direct banks are ahead of the cooperative banks in this study. What is striking here is that in the 16-19 age group, the share of Volks- und Raiffeisenbanken with 20% is ahead of that of direct banks with 14%. The savings banks have the highest share in this age group with 48% in the entire survey.

So if the house bank enjoys the highest level of trust, the question arises as to which one it is. In response to the question “At which bank do you have your mainly used current account?” most respondents named the savings banks. The direct banks are ahead of the cooperative banks in this study. What is striking here is that in the 16-19 age group, the share of Volks- und Raiffeisenbanken with 20% is ahead of that of direct banks with 14%. The savings banks have the highest share in this age group with 48% in the entire survey.

ibi research

As a member of the ibi partner network, we have access to the entire study. The publication is planned for autumn.

Share