An article by

Andreas Wegmann

Published on

18/03/2025

Updated on

18/03/2025

Reading time

2 min

When the regulatory obligation to Verification of Payee (VOP) arose for banks, the question also arose as to how banks should technically manage the processing among themselves. A VOP request takes place prior to a credit transfer (SEPA Credit Transfer – SCT) or a real-time transfer (SEPA Instant – SCT Inst) and has nothing to do with the actual “movement” of money. In order not to burden the clearing and settlement systems, independent systems are foreseen for VOP.

What happens with Verification of Payee in a bank?

Firstly, a distinction must be made between incoming and outgoing enquiries:

For incoming enquiries, a bank must check data on its own account holders and provide a corresponding response. In the case of natural persons as account holders, the name is checked, i.e. the bank must maintain a system that compares the name in the enquiry with the name of the account holder in its own system. Depending on the result, a response (match, no match, close match) is returned, whereby the bank must bear the consequences of the response. The essential component for this part of a VOP solution is therefore the verification of enquiries.

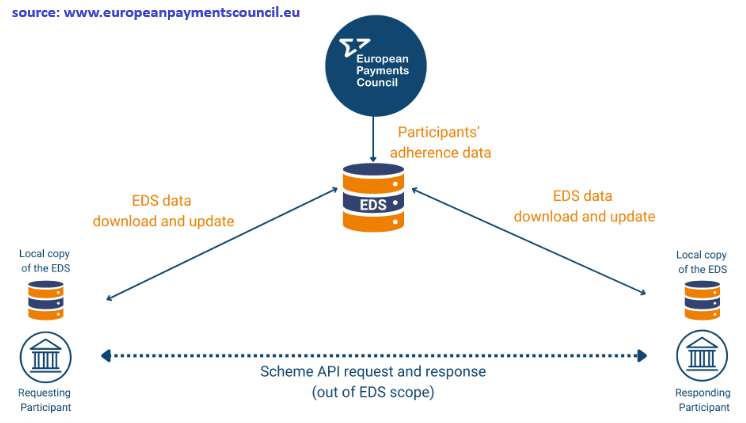

For outgoing requests, i.e. when your own account holders want to send money to others, the tecnical address to which the request is to be sent must first be determined. The EPC manages a directory (EPC Directory Service – EDS) where each bank can store its own electronic address for VOP requests. As soon as the EDS has determined where the request must be sent, the actual request can be sent. The essential component for outgoing VOP requests is therefore the routing.

In addition to a bank’s own VOP solution, the EPC also defines service providers who handle VOP requests for banks.

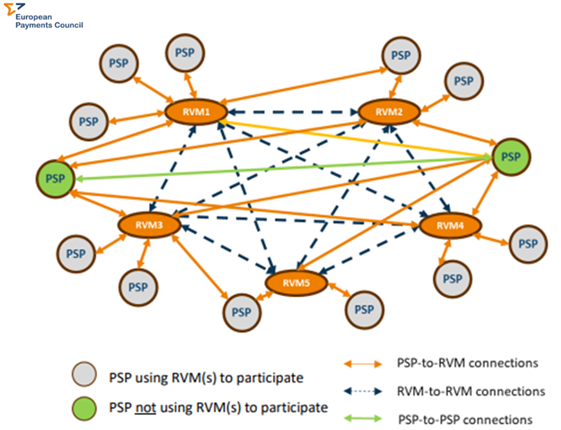

Routing and/or Verification Mechanism – RVM

From the perspective of most banks, the handling of VOP requests is suitable for outsourcing, as it is usually seen as a chore. The prospect of joining the flow of around 30 billion SEPA credit transfers per year as a service provider in the long term appears lucrative to many companies and several dozen companies have applied to the EPC for authorisation as an RVM. An RVM is therefore an independent company that takes over the processing of incoming and outgoing Verification of Payee requests for several banks (Payment Service Provider – PSP).

However, RVMs must also fulfil certain obligations:

- Registration with the EPC with your own BIC

- the provision of a test environment

- Reporting to the EPC on the executed VOP requests

If you are a PSP interested in VOP solutions, we look forward to hearing from you.

Share