Published on

19/07/2022

Updated on

03/11/2023

Reading time

3 min

Table of content

Many people do not know the term “virtual IBAN” or find it difficult to define. Yet it is very likely that they also use VIBANs unnoticed. This article explains the term and its benefits for the SEPA area in a simplified way.

Virtual IBAN – “normal IBAN”

A “normal” account at a SEPA bank is assigned an “International Bank Account Number”, IBAN for short. Such an IBAN contains the identification of the bank (Bank Identifier Code – BIC), the account number, a country code and a check digit (prevents input errors). It is also called a physical IBAN, as it can be clearly assigned comparable to a “physical address”.

The idea of a virtual IBAN is to allow further IBANs one level below. These “virtual” accounts are therefore not independent, but merely subdivide the credit balance of the corresponding physical account. With regard to payment transactions with other SEPA banks, VIBANs are not restricted, i.e. they can send and receive payments. The holder of the physical account is responsible for all transactions. Good VIBAN systems allow account holders to handle their IBANs automatically in real time.

Who uses a virtual IBAN?

Many banks offer virtual IBANs to their corporate clients so that they can optimise their payment transactions or accounting. For example, individual branches can receive their own VIBAN to increase the transparency of monetary transactions in a group. Real estate groups also often create a virtual IBAN not only per property, but also per tenant. So the idea is anything but new, but with the increasing speed of bank IT systems and rising process automation, more use cases are becoming possible. Where an account used to be set up manually during office hours, today a bank account can be made usable immediately and at any time. Even a single business transaction can get its own VIBAN. Especially in combination with real-time payments (SEPA instant payments), VIBANs open up “fast-paced”, fully automated business models.

Where to put the money?

With many business ideas in e-commerce, “parking” funds is indeed a big problem, especially if the payment and the corresponding service are separated in time. Managing funds requires a (partial) banking licence in the EU. When an EU citizen buys a voucher through an intermediary, for example, the EU banking supervisor makes sure that the money is not misappropriated. The intermediary is not allowed to mix the proceeds with his assets, but must hold them in trust until the equivalent value has been paid. Virtual IBANs simplify and cheapen such transactions.

Not every pizza delivered by a delivery service is accounted for in this way, but a voucher for a parachute jump usually is.

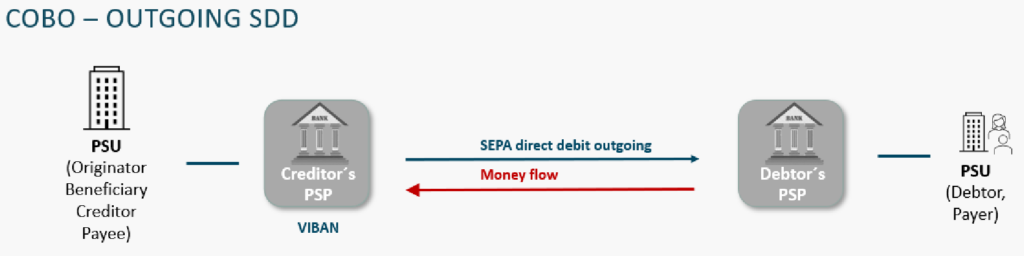

COBO – Collecting on behalf of others

Technically, a VIBAN can be used in payment transactions in the same way as a physical IBAN, but there are regulatory differences. In the simple case, a VIBAN is used to “collect” money. Example: in an online shop, advance payment is agreed and this purchase receives its own VIBAN. Even without information in the reason for payment, the payment is correctly allocated because the VIBAN was only created for this one incoming payment (and possible return). As always with SEPA payments, not only incoming transfers (incoming SEPA credit transfer) but also direct debits (outgoing SEPA direct debit) are suitable for collecting funds.

PSU = payment service user, account holder

Mobile phone operators often have VIBANs for their customers to collect the charges from their phone customers by direct debit.

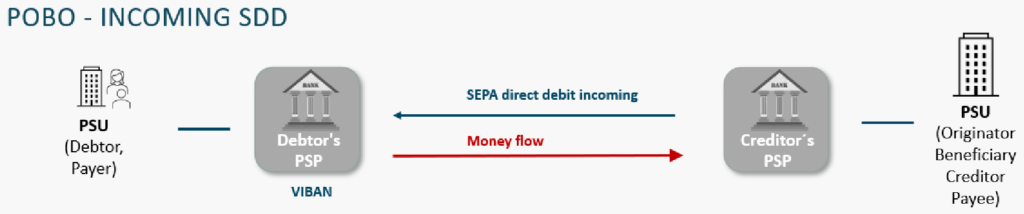

POBO – Payment on behalf of others

A significantly higher risk of money laundering and terrorist financing arises when money is also paid out to third parties via VIBANs. Bad actors like to use the fast and fully automated processing of VIBAN systems, e.g. to split up significant amounts and transfer them by means of a large number of small amounts.

A payout can also be made not only as a SEPA credit transfer but also via an incoming SEPA direct debit transaction if the VIBAN account can receive direct debits.

If you have further questions about VIBAN systems, please use our contact form.

Share