Published on

17/06/2024

Updated on

23/05/2025

Reading time

3 min

Table of content

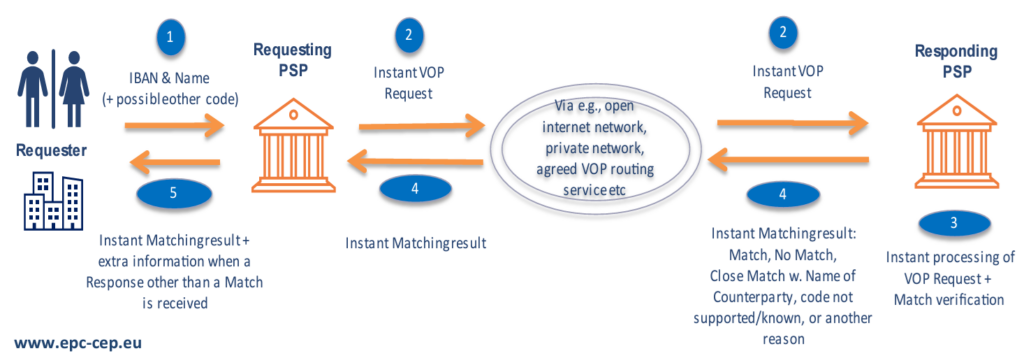

The Verification of Payee (VOP) scheme is a mandatory set of rules for payment service providers (PSPs, commonly known as banks; other payment service providers, e-money institutions) in the Single Euro Payments Area (SEPA). It defines procedures in advance of a payment transaction so that the identity of the payee can be verified before the payment is executed. The VOP scheme serves to prevent so-called Authorised Push Payment Fraud (APP), in which the payer is deceived about the identity of the payee.

Procedure for the “Verification of Payee”

The name of an account holder does not play a role in the processing of SEPA interbank payments so far (nor does it for Visa or MasterCard card payments in SEPA). Although the name of the recipient must be stated for payments, it is currently not checked by the receiving bank. The obligation to verify the payee enables the payer to check the payee’s name in advance when making a credit transfer (SEPA credit transfer) or SEPA instant credit transfer. The name of the account holder can principally also be checked for direct debits (SEPA direct debit).

The procedure for the Verification of Payee is upstream of the actual payment and the payment can be executed regardless of the result of a check. The processes in the clearing and settlement systems therefore remain unchanged.

What obligations do banks have?

Originally, the Verification of Payee obligation was linked to the so-called Instant Payment Regulation and initially, real-time payments (SEPA Instant Payments, SCT Inst) were to be processed first with VOP. In the meantime, the EPC has decided that Verification of Payee must also be offered for the regular SEPA credit transfers (SCT) at the same time.

The VOP scheme will come into force on 5th October 2025, i.e. SEPA instant payments and retail payments must have a name check by this date.

The challenge VOP

The challenge VOP

Banks are faced with the question of how to efficiently implement the Verification of Payee obligation. As real-time payments are treated as individual transactions, but bulk payments are processed with batch or bulk files, flexible solutions must be found. The systems must also be able to check within five seconds not only the name of the account holder, but also other identifiers of an account e.g. a legal entity identifier (LEI). It is clear that banks must offer the VOP on “all channels” on which customers can initiate payments. This is comparatively easy in online and mobile banking, but the service is more difficult to fulfil in telephone banking and branches.

Despite all the effort involved, a bank may not charge any additional costs for a Verification of Payee check.

Match, No Match and Close Match

As already mentioned in an earlier article, the rules for partial matches will also be the subject of much discussion. In addition to a “match” or “no match”, there is also a partial match (close match) that also should return the actual account holder name. The consequences of an incorrect Verification of Payee response are considerable: if a bank does not comply with the specifications, it is liable for the loss in the event of fraud. The rules for a “close match” in the area of tension with a recommended minimized data return are not clearly defined and problem areas remain, such as:

- different character sets (Greek alphabet, etc.)

- company abbreviations and legal forms

- joint accounts

If you are looking for a Verification of Payee solution like CPG.vop for your company, we look forward to hearing from you here.

Share