An article by

Andreas Wegmann

Published on

23/01/2023

Updated on

04/11/2023

Reading time

3 min

The transmission of financial transactions must of course take place with the highest possible security. At the same time, this security should not have to be bought at a high price by proprietary system solutions or lead to technical dependency. A successful example of minimising disadvantages and maximising advantages is the EBICS communication standard.

What is EBICS?

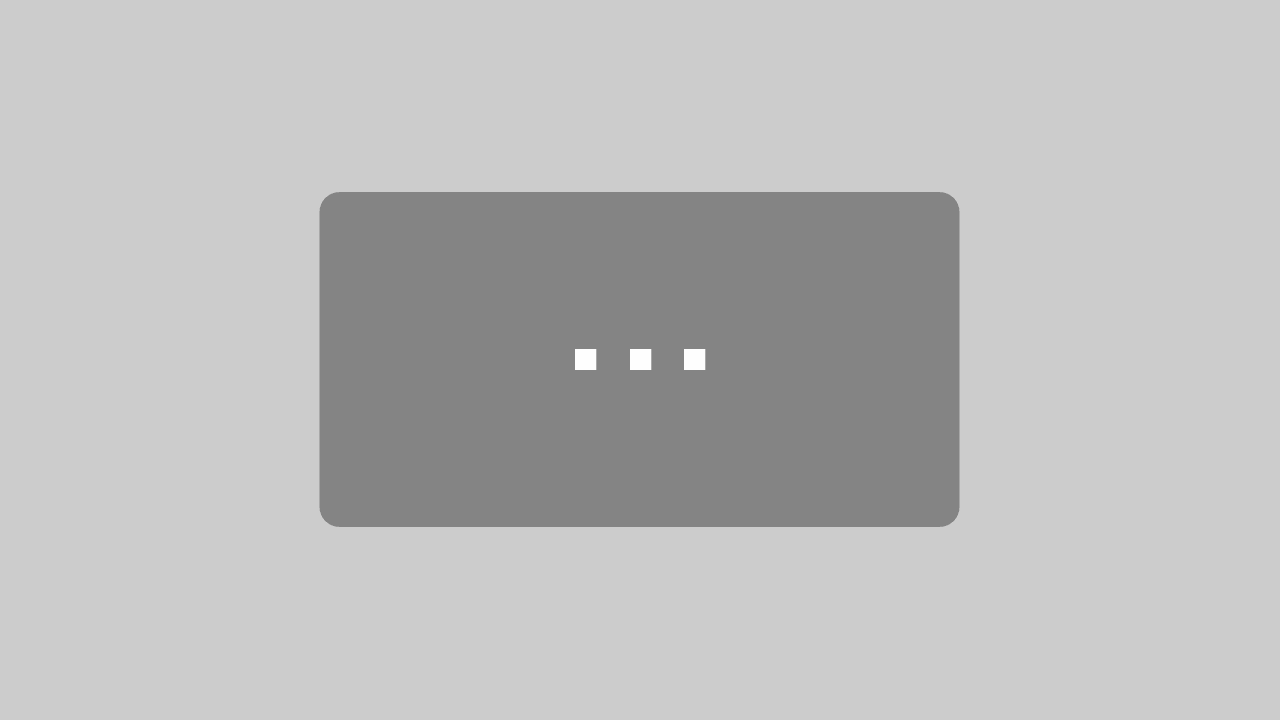

EBICS (Electronic Banking Internet Communication Standard) is used to transmit financial transactions between (corporate) customers and their bank. Likewise, EBICS is used in interbank payment transactions, whereby additional functions are required here. The Association of German Banks (www.die-dk.de, or the predecessor organisation ZKA) developed this open standard in 2006 in order to create an independent, powerful and future-proof possibility for transaction transmission.

In the meantime, France, Austria and Switzerland have joined the EBICS society, so that the path to the European standard is marked out. International corporate customers are a driving force in this development because they do not want to communicate differently with each bank and in each country.

Open standard vs. vendor-based solution

The most unusual feature of EBICS is that it is an open standard that uses the Internet as a transmission path. In principle, every company can program its own solution to use it itself or to market it. This has created a functioning competition among software providers, so that EBICS is unrivalled worldwide in terms of cost efficiency.

In comparison, transaction transmission, e.g. via SWIFT, is always tied to the software and hardware used there. The SWIFTnet is an independent communication network whose costs must be shared among the users. A dedicated communication network may promise more security, but naturally has very high running costs.

The advantages of EBICS

Inexpensive

Since transactions are transmitted via the internet, there are no additional costs for the infrastructure. Availability can be optimised with better internet access if required.

Multi-bank capable and flexible

Transparent management of different communication partners (clearing systems, partner banks) is important not only for corporate customers, but also in interbank payment transactions. In bilateral relationships, individual message formats (e.g. contract data) can be transmitted so that intensive partnerships are possible.

Fail safe and robust

In contrast to SWIFTnet, EBICS is a decentralised solution and therefore neither a “single point of failure” nor a “single point of spying” (as is well known, SWIFT is monitored by the NSA). If technical faults occur, EBICS recognises the interruption and completes the transmission independently.

Distributed Electronic Signature

Distributed Electronic Signature

One of the great technical advantages of EBICS is the possibility of a temporal and spatial distribution of transaction and payment release. In Germany, this function has been used intensively for a long time and is therefore technically very mature in EBICS. In France or Switzerland, the function only exists with the introduction of EBICS 3.0 and now the usage rates are also increasing there.

Future proof

In its original conception, EBICS was designed for mass payment transactions (e.g. with the SEPA Clearer) and thus for bulk processing. However, the architecture has also allowed rapid adaptation to single transactions in real time (SEPA Instant Payments). The SCT Inst service RT1 of EBA Clearing can be used via EBICS. Real-time notification for incoming transactions as a supplement to the processing of SCT Inst transactions (for corporate customers) is also defined in the standard.

With regard to future security standards, future viability has already been demonstrated: not only in the improved encryption on the Internet (from SSL to TLS), but also in the internal encryption of the message (from Triple-DES to AES).

Disadvantages?

The advantage of decentralisation has led to the emergence of “dialects”. For example, different specifications for encryption were made in France and technical specifications were also interpreted differently in Switzerland. True internationality has therefore not yet been achieved for EBICS. Modern payment traffic systems such as CPG.classic can help to overcome these hurdles.

Summary

Banks in the SEPA area must keep an eye on the development of EBICS if they are not already using this technology.

If you have any further questions, please use our contact form.

If you would like to know more about a payment solution that masters all relevant communication channels, you can learn more in this youtube video:

Share