An article by

Andreas Wegmann

Published on

15/11/2021

Updated on

24/10/2022

Reading time

3 min

Table of content

Update: the ECB has announced the postponement of the “Big Bäng” to 20.03.2023 via press release dated 20.10.2022!

*******************************************************************************************

The ECB’s TARGET market infrastructure will be converted in November 2022. What sounds harmless is a major challenge for SEPA banks. Some aspects of the TARGET2 Big Bang are explained in this post.

What does the TARGET2 Big Bang change?

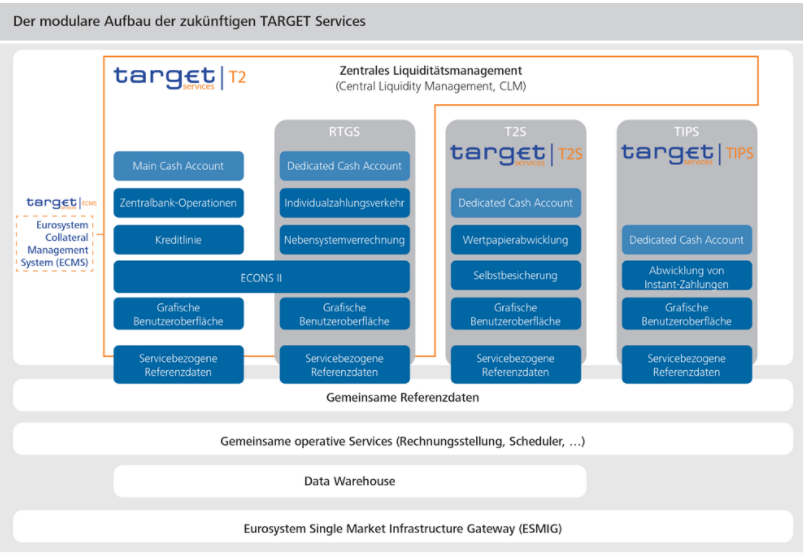

The TARGET2 / T2S consolidation is intended to make the existing infrastructure more efficient. This includes

- centralization of the systems (including liquidity control and master data)

- breaking the monopoly of SWIFT as an access system and

- switch to future-proof message formats (IS0 20022).

Although the name seems to remain the same, the IT system is fundamentally new. The direct SEPA participant banks have to adapt technically and organizationally to the new T2 / T2S.

Why a big bang?

The processing of financial transactions requires the highest security standards for IT systems. The ECB’s infrastructure is not only a clearing system for payments, but also for securities. The following video explains the essentials about clearing procedures in interbank payments:

In addition, the national banks control the minimum reserve of their participants here, among other things. In the case of the Bundesbank, this is more than 1,000 banks.

This multitude of vital tasks lead to a very high level of complexity that cannot be transferred to parallel operation for smooth migration.

The same level of complexity exists on the banking side, with corresponding consequences: all processes and programs have to be adapted. For banks, too, it would usually not be economically feasible to operate two systems, new and old, in parallel, as a demarcation (division of tasks) is very difficult.

No plan B

When the financial world adopts new norms or rules, delays are more the rule than the exception. Systemically important banks could delay the TARGET2 Big Bang if they do not complete their conversion project on time. The ECB has therefore introduced intensive monitoring of the project progress at these banks in order to be able to take countermeasures in good time. In an extreme case, the business activities of a bank would be “dwarfed” before the TARGET2 Big Bang until it is no longer systemically relevant. But all other banks must also continuously prove that they are preparing for the changeover. If a bank is actually unable to deal with the new system by the deadline, this will definitely lead to its ruin within a few days.

What must banks do for the TARGET2 Big Bang?

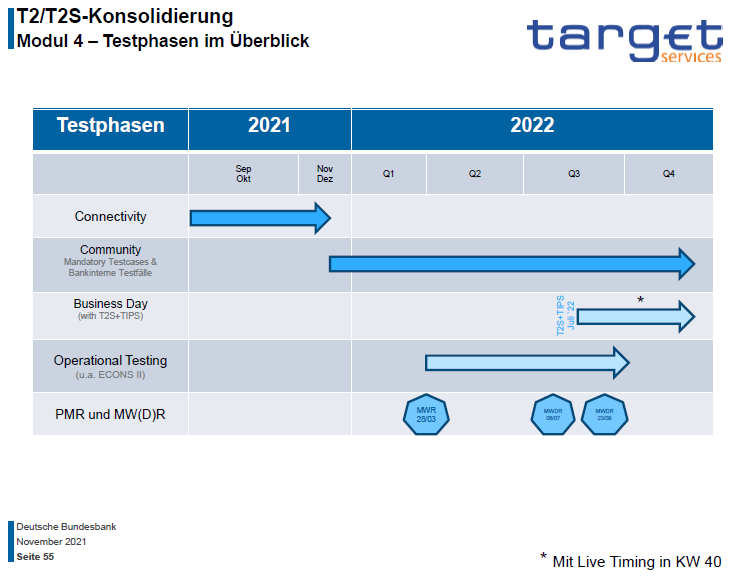

Years ago the Bundesbank began to adapt its direct SEPA participants to the consequences of the changeover. The fulfillment of work packages must be proven step by step. For example, the applications for setting up the cash accounts must be submitted by the end of 2021.

By Q3 2022 at the latest, extensive tests must be carried out to demonstrate the ability to handle the new infrastructure. These tests not only affect the IT systems (A2A tests, A = application) but also the training of employees (U2A, U = user). The entire documentation about it, as well as all manuals and specifications fill many thousands of pages. The content is conveyed in numerous online events and dedicated support teams provide assistance.

Failure is not an option.

Share