An article by

Andreas Wegmann

Published on

20/02/2025

Updated on

20/02/2025

Reading time

2 min

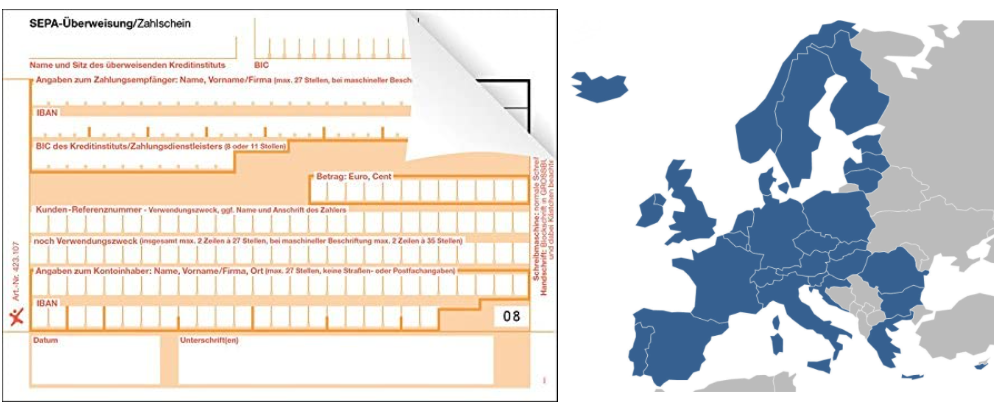

The EU wants to strengthen competition in the financial sector and create fair competitive conditions, including for small companies. In addition to the “real banks” (payment service providers – PSPs), so-called payment service providers have also been authorised for a long time, which are only permitted to process payments. They are not allowed to engage in credit and deposit transactions, which means that their sources of income are limited to transaction and account management fees. These non-bank payment service providers (NB-PSPs) previously required a PSP in order to be able to process (clear) SEPA payments. Direct TARGET access, the EU’s own clearing system, has so far been denied to them. Decision (EU) [2024/[XX]] of the European Central Bank (ECB) of 27 January 2025 now changes this.

TARGET access surprisingly fast

TARGET access surprisingly fast

There were concrete considerations for the opening of the TARGET system in the draft Payment Service Directive 3 (PSD3). This third Payment Services Directive from the European Commission is expected in the first half of 2026. The PSDs are a series of regulations for the payments industry (PSD1 from 2007, PSD2 from 2015), which are intended to create a standardised legal basis for payment transactions in the EU.

However, with the ECB decision, access to TARGET will now be possible for NB-PSPs from 16 June 2025!

Summary of the ECB decision

- Access requirements: NB-PSPs must fulfil certain technical and security requirements and provide confirmation from their national supervisory authority in order to gain access to the payment systems. The necessary IT infrastructure corresponds to the known requirements for TARGET participants.

- No custody accounts: Eurosystem central banks are not allowed to offer custody accounts for NB-PSPs or crypto-asset service providers. This means that no interest income can be earned from deposits at the central bank.

- Maximum credit balances: There are upper limits on the balances that NB-PSPs may hold in their accounts with the payment systems. These limits are regularly reviewed and adjusted and are intended to reflect business operations.

- Sanctions for violations: Failure to comply with the upper limits or other requirements may result in fines and, in extreme cases, termination of participation in the payment system.

You can find the full ECB decision text here.

TARGET access for non-banks will therefore only be worthwhile for high transaction volumes and it is advisable to consider the existing solution with a partner bank.

If you are considering your own TARGET access and would like to find out more about the technical systems, we look forward to hearing from you.

Share