Posts Tagged ‘SEPA Payments’

The Downfall of the Card Industry

The global card industry will certainly not go under any time soon, but at least in the Euro countries it will lose business from 2025. SEPA Instant Payments (SCT Inst) will be able to replace card payments in many cases. The article explains why this is the case. Cashless Payment with Card or Smartphone Fewer…

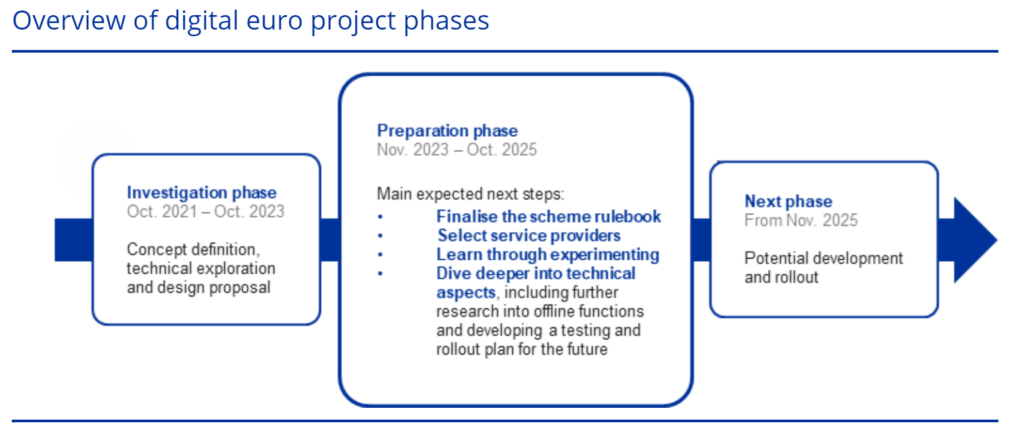

Read MoreStatus of the digital Euro (D€)

Anyone travelling across the eurozone can make cash payments in Euros everywhere without any problems, but not cashless payments. The individual Euro countries and their banks continue to maintain their national payment systems (such as the girocard in Germany), which usually cannot be used across borders (unless the card is combined with an additional “scheme”).…

Read MoreSCT Inst Bulk Processing

Retail payment transactions generally are not handled as single transactions but with bulk files. Corporates in the SEPA area submit payments to their house bank in pain messages. This XML structure allows the creation of so-called bulks, i.e. a large number of payments can be transmitted in a structured manner. The SEPA Bank converts the…

Read MoreThe Deutsche Bundesbank’s SEPA Clearer

With the TARGET system, the EU has created the infrastructure for clearing and settling cross-border payments between Euro countries. The vast majority of transactions take place domestically and here the respective national bank is required to offer efficient solutions to the banks in their country. The Bundesbank’s system for these retail payments is called SEPA…

Read MoreEPC November Release 2023

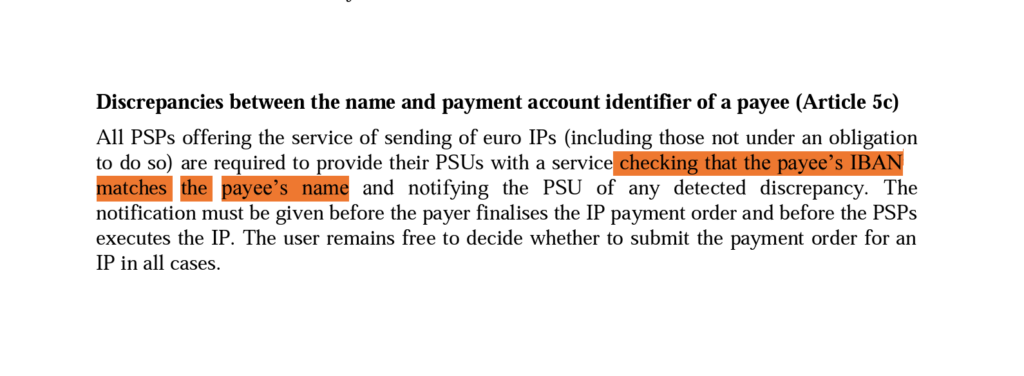

SEPA Name check

Anyone making a credit transfer (or direct debit) in the SEPA area enters the name of the recipient (or payer), but this is currently not matched by the bank. Simple transposed numbers are effectively prevented by the IBAN check digit. However, if fraudsters send a forged invoice to a victim, for example, the recipient’s name…

Read MorePayment transaction statistics

“You can prove anything with statistics, even the opposite” is a quote from James Callaghan. There are also countless statistics in the field of “payment” and very few of them are actually helpful. The players in the industry like to “prove” their own (often supposed) market leadership or consulting companies publish international studies to prove…

Read MoreSEPA Request to Pay – Quo vadis?

The EPC Scheme Rulebook for SEPA Request to Pay (SRTP) has been available since June 2020 after many years of discussion in advance. There is now a second edition and the interbank infrastructure for processing is also in operation. The topic is much discussed because companies and retailers hope for lower fees in payment transactions…

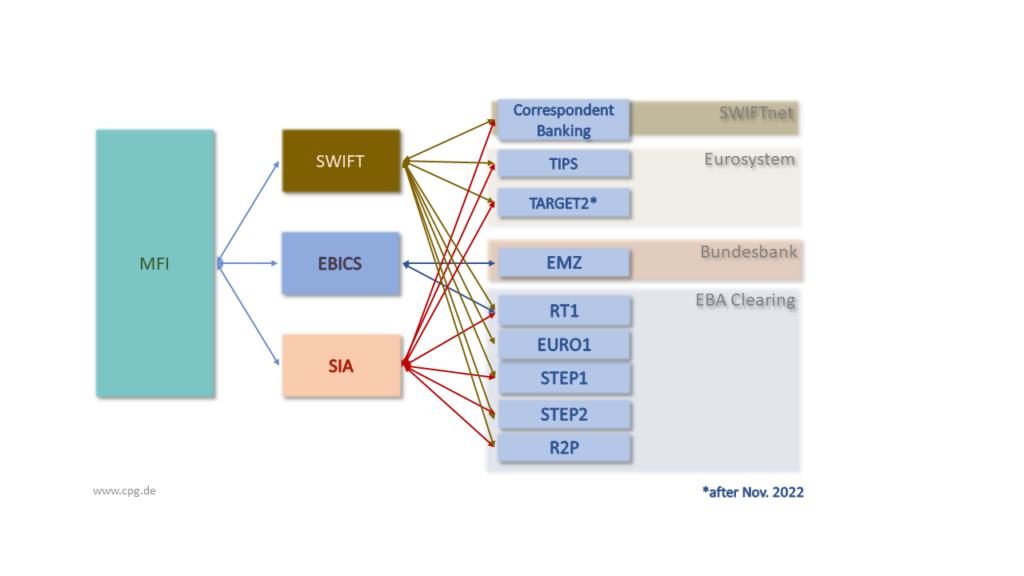

Read MoreTARGET2 SEPA SWIFT payments system

A modern payments system software for banks must be able to deal with many different internal and external systems. Both the regulation and the market requirements are becoming increasingly dynamic, so that flexibility is becoming more important. This article explains the most important functions and tasks for a “TARGET2 SEPA SWIFT payments system”. TARGET2 SEPA…

Read MoreSEPA TARGET SWIFT Software – how is the interaction?

A “SEPA TARGET SWIFT software” handles transactions in interbank payments. Anyone who is not active in this field usually only has a rough idea of what the words mean. This article gives a simplified overview. SEPA A good deal of misunderstanding is created by the fuzzy use of terms. This happens frequently with “SEPA” in…

Read More