An article by

Andreas Wegmann

Published on

14/07/2021

Updated on

01/11/2023

Reading time

3 min

When companies receive or make international money transfers, they can use the SWIFT gpi Tracker for corporates to see which financial institutions are involved in the transaction. The background to this service and how corporate clients can use it is explained in following article.

What is SWIFT?

In order to understand the function of the SWIFT gpi tracker, one must first understand the function of SWIFT. SWIFT is an organization of banks around the world that carries out communications services for financial transactions between financial institutions. On the one hand, specific SWIFT MX MX message types are defined as communication formats, on the other hand, messages of these types are also transmitted via dedicated SWIFT interfaces: the so-called SWIFT Net.

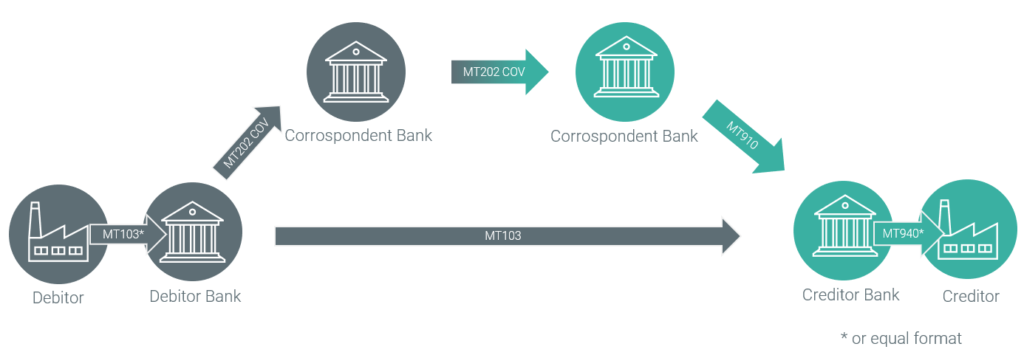

SWIFT itself is not a clearing and settlement mechanism, i.e. no accounts are kept. “Only” messages about financial transactions are exchanged. Each participant has their own identifier, a SWIFT code or BIC (Bank Identifier Code). If a bank (debtor) wants to send money to another bank (creditor), but both banks have no mutual accounts, the route to the recipient can be determined via SWIFT.

With the help of correspondent banks, the money is then “moved” until it can be credited to the recipient’s account.

The correspondent banking system

There are around 200 banks around the world that actively act as correspondent banks. Transferring funds for other banks for a fee is therefore an essential part of doing business. In addition, they can usually also carry out a currency exchange if necessary and earn a margin in the process. In countries with a poorly developed financial infrastructure, these banks perform an important role.

Five or more banks are often involved in international money transfers. Not all banks process money transfers immediately, but have specific processing times and only release amounts manually.

If a debtor bank has no experience of previous transactions, it cannot predict the duration, costs or exchange rates of a credit transfer. SWIFT does not provide any data for this. The stations of past transactions cannot be easily traced in SWIFT either. This weakness provides criminals with money laundering and tax evasion opportunities.

How works the SWIFT gpi Tracker for Corporates?

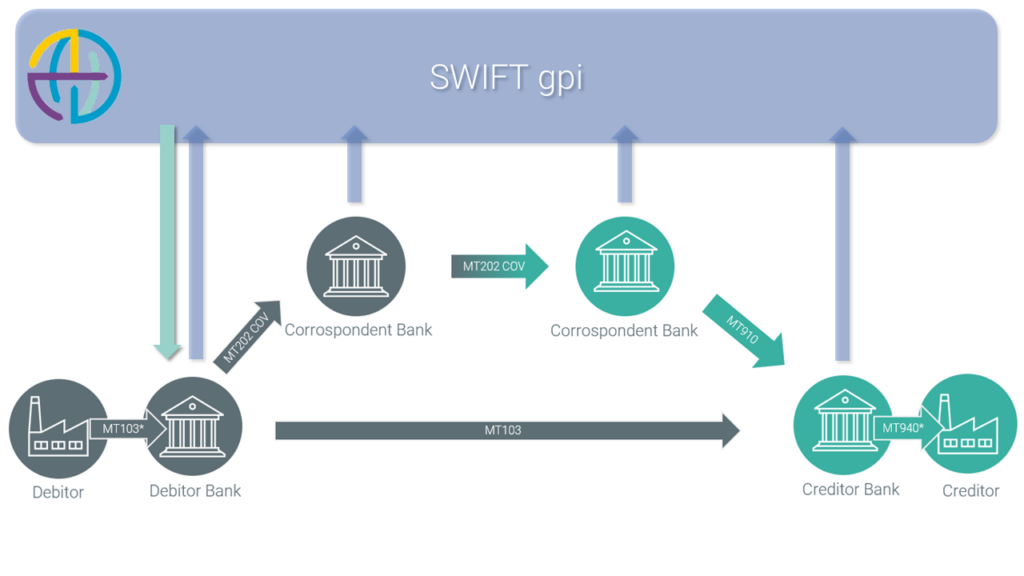

Most banks are of course not interested in being instrumentalized by criminals and therefore SWIFT has developed a solution with gpi to make financial transactions more transparent. “gpi” is the abbreviation for “global payment innovation”, which unfortunately is not a very meaningful name for the system. The way it works is quite trivial: in simple terms, the debtor bank reports the transfer to a central database in addition to the SWIFT messages. Every bank that is involved in the money transfer also reports the booking to this system and also the fees withheld. The debtor bank can access the data via the so-called “tracker” and thus always knows where the money is and what fees have been incurred.

All banks are now forced to report data to gpi (see article SWIFT gpi Tracker: MT199 mandatory for FIN from 11/2020) and modern payment systems such as CPG.classic can meet these requirements. The debtor bank must also send a “UETR” (Unique End-to-End Transaction Reference) to gpi in order to simplify the tracking of transactions. If banks fail to comply with the gpi reporting requirement or only forward funds with a delay, this is incorporated into a rating system. If the misconduct persists, they are threatened with exclusion from SWIFT.

How can companies use the SWIFT gpi Tracker?

![]() Of course, when companies send money, you expect an insight into the history of the transaction. Large companies with their own BIC can access the tracker. However, many banks shy away from the expense of providing their corporate clients with the data from the SWIFT gpi Tracker.

Of course, when companies send money, you expect an insight into the history of the transaction. Large companies with their own BIC can access the tracker. However, many banks shy away from the expense of providing their corporate clients with the data from the SWIFT gpi Tracker.

The solution for companies can be new banks that specialize in these business transactions. The registration process for an account has to be completed, but the preparation of the data is exemplary. We are happy to recommend a suitable provider. Please use our contact form.

Share