An article by

Andreas Wegmann

Published on

30/09/2024

Updated on

30/09/2024

Reading time

4 min

Anyone travelling across the eurozone can make cash payments in Euros everywhere without any problems, but not cashless payments. The individual Euro countries and their banks continue to maintain their national payment systems (such as the girocard in Germany), which usually cannot be used across borders (unless the card is combined with an additional “scheme”). EU travellers have to resort to internationally valid payment options and equip themselves with credit or debit cards that are issued by the domestic bank but whose operation is determined by organisations outside the EU. So there is nothing more obvious for EU policy than to create its own system to further standardise cashless payment transactions: the digital Euro (D€).

D€ – Payment Method or New Currency?

The simplest and most obvious solution for the EU’s own payment procedure would have been to create a new “card scheme” that regulates the technical, legal and commercial processes. However, this would hardly have been able to fulfil the requirement of enabling anonymous payment transactions between citizens. Combining the anonymity of cash with digital usability can be achieved using a so-called digital token. The D€ is such a token. However, it is not a new digital currency, but the digital manifestation of the euro. In addition to the colourful printed notes and metal plates (cash) and fiat money, the Euro will also exist as a token in the future. The abolition of cash is expressly not planned.

Who “prints” the Token?

The provision of cash is part of a state’s infrastructure and the taxpayer bears the costs of this. When banks convert their fiat money into cash, e.g. to hand out to their customers, they do not have to pay for printing the cash. They are not allowed to print the cash themselves; instead, the respective national bank must ensure that the banks are supplied with cash. In principle, the same applies to the digital euro: the European Central Bank issues the D€ and the EU banks can distribute it among their citizens. All use by citizens is free of charge.

What is the Status of the Digital Euro?

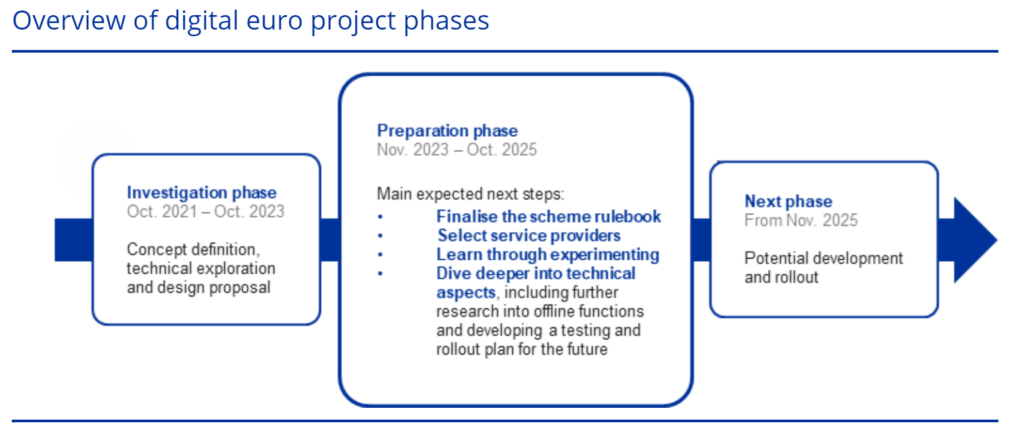

The ECB regularly publishes detailed information on the characteristics of the digital euro and the progress of the project. There are of course many stakeholders with different interests and opinions and ultimately all EU bodies must agree to the implementation.

At the end of the preparation phase, the following facts have been finalised:

- Privacy by design” applies because the protection of privacy is a fundamental feature of the D€.

- The D€ wallet is provided by the ECB and can be issued free of charge by banks to private customers (or by the ECB directly).

- Banks can integrate the wallet into their banking app, for example, or develop their own wallets.

- It should be possible to have several wallets, even at different banks. However, there should be a maximum holding limit for D€s per person in order to prevent high value storage.

- Similar to a joint account, there will also be a joint D€ wallet (e.g. for life partners).

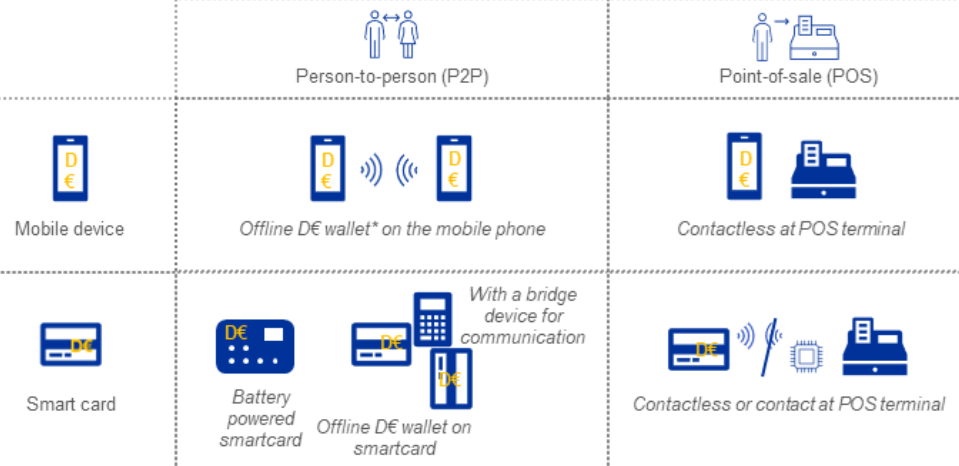

- Offline transactions between two users (private use, person-to-person, P2P) will be possible, i.e. neither party needs to be connected to the D€ system (via the Internet) at the time of the transaction. There will be an amount limit for this type of transaction, which has yet to be determined, and the number of offline P2P transactions will probably also be limited.

- Although a (private customer) wallet can be operated without a bank account, it should generally be linked to an account, as transfers between account and wallet will be easily possible. The amount limits for offline transactions do not apply to “connected” D€ wallets, meaning that larger amounts can be processed.

- Another equivalent application scenario is in-store payment (point of sale, POS), whereby there must be an online connection at least on the merchant’s side. There is therefore a special variant of the D€ Wallet for merchants, which must be linked to a business account. Transactions are always forwarded directly to the account (no holding limit). Banks may charge fees for use, which are capped by the ECB. The ECB itself will not charge any fees.

- It is likely that merchants will be obliged to accept D€.

- Smartphones are expected to be the primary technical basis for the D€ wallet, with manufacturers possibly being forced to grant access to the so-called “secure element” of the devices (necessary for offline transactions).

- In addition to smartphones, it will be possible to use a D€ Wallet by means of an (active) smartcard. This must either have its own battery or be powered by another device.

- Usability in e-commerce should be guaranteed.

- Thanks to a novel combination of anonymisation, encryption and hashing, transactions will not be directly traceable, i.e. there is no central location where transactions can be viewed by all senders and recipients. Investigators would have to research the data at the banks involved (as with an IBAN account).

- The wallet will have an amount limit to be defined because it is only intended to serve as a limited store of value. Amounts will not earn interest.

- There will be an arbitration centre for disputed transactions.

- The ECB reserves the right to revise the implementation of the D€ again in the event of new findings from the tests or technological innovations.

- A decision is to be made by the end of 2025 as to whether the digital euro will actually be introduced.It is to be expected that the digital euro will add another facet to payment transactions for banks. We are monitoring developments very closely in order to enable our customers to clear D€ transactions in addition to the existing SEPA and SWIFT solutions. If you have any questions about our software solutions for payment transactions, we look forward to hearing from you here!

Source: EZB

Share