Published on

02/01/2024

Updated on

02/01/2024

Reading time

< 1 min

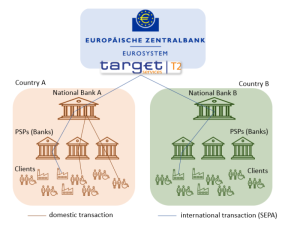

The current draft of PSD3 proposes that Payment and E-Money institutions (PI, EMI) be given direct access to clearing systems. The "real banks" are campaigning against this because they fear additional competition.

EU banking services objectives

EU banking services objectives

When it comes to financial services, the EU always pursues the same goals:

- Promoting innovation

- Consumer protection

- Fair competition within the EU

- Sovereignty over infrastructure

The banking structure is very different in the individual member states and the interests are often just as diverse. So there are many cooks with different flavours stirring the pot. Once the countries have reached a consensus, the instruments for enforcing the objectives are a regulation (effectively an EU-wide law) or a directive (which the states must transpose into national law).

Big eats small

Big eats small

Unfortunately, conflicts of interest arise in the pursuit of objectives, i.e. what serves one cause is detrimental to another. One example of this is the protection of consumers against fraud. Appropriate measures are imposed on banks (two-factor authentication, name matching for payments, etc.) which entail high investments.

Large banks naturally find it easier to cope with such expenditure, while small banks often become takeover candidates. This is bad for competition among banking service providers. The big ones get bigger and bigger and, in the worst case scenario, become "system-critical" at some point, i.e. if they fail, they have to be kept alive with taxpayers' money.

Unequal battle

Unequal battle

Innovations are much more likely to emerge in small companies and if these are to be promoted, the regulator must also ensure level playing field.

When it comes to payment transactions, PIs and EMIs institutions are currently only allowed to operate with a "real" bank as a partner. This banking partner is not only a cost factor, but often also technically limits the clearing processes. Innovative payment service providers therefore lack the basis to compete on an equal footing with established banks. Some of these "non-bank payment service providers" have formed an interest group at https://www.eudirectaccess.com/.

Conclusion

Conclusion

If the EU wants to promote innovative payment solutions, access to clearing systems for PIs and EMIs is urgently needed. At the same time, the distribution of payment services among many small players will lead to a more robust and manageable overall system. Of course, established banks will lose some of their business, but this is not a disadvantage for EU citizens and companies.

Share