An article by

Andreas Wegmann

Published on

10/07/2023

Updated on

16/04/2025

Reading time

3 min

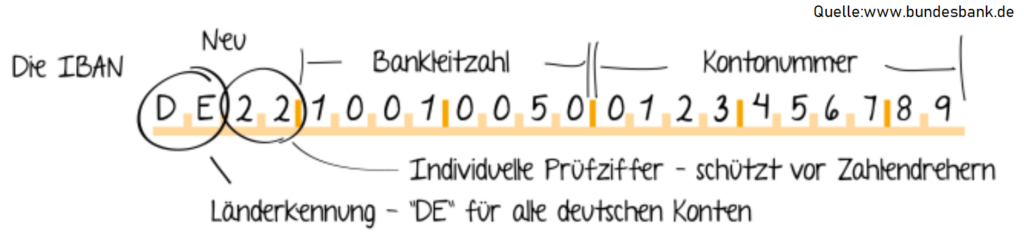

Anyone making a credit transfer (or direct debit) in the SEPA area enters the name of the recipient (or payer), but this is currently not matched by the bank. Simple transposed numbers are effectively prevented by the IBAN check digit. However, if fraudsters send a forged invoice to a victim, for example, the recipient’s name cannot be checked today when the transfer is made. The SEPA name check according to Verification of Payee (VOP) will change this starting from 5th of October 2025.

What is the SEPA name check according to Verification of Payee?

The European Commission has passed a regulation of SEPA instant payments, which, among other things, enables the payer to check the name of the payee. The payer enters the IBAN and the name of the recipient and receives – before he initiates the payment – information as to whether the specified recipient is registered under this name at the recipient bank for the specified IBAN.

In addition, the payer should be able to initiate the payment even if the check does not show a match. This regulation will also apply to traditional SEPA Credit Transfers (SCT) from 5 October 2025.

Right, almost right, quite wrong or completely wrong?

It is obvious that the correct name of the payee must not simply be disclosed to the payer for reasons of data protection. The payer should not be able to ask for anything that he does not already know himself. Data minimization should therefore be used. It is equally obvious that in the case of names, the different spellings, abbreviations and character sets very quickly lead to discrepancies. Does “G. Muellér” possibly mean “Gerd Müller”? This must be taken into account during the SEPA name check according to the Verification of Payee process. The EPC provides corresponding recommendations for the matching process. The payer should be given an “close match”.

A number of so-called VOP Routing and/or Verification Mechanism (RVM) service providers have formed to provide SEPA banks with suitable IT systems for SEPA name verification and these rely on a tiered feedback process.

Who benefits from the SEPA name check?

Ideally (name and IBAN are confirmed), the payer actually benefits from the check. If the check is “close match” and the transaction turns out to be fraudulent, the payer has the same legal status as without the check: he must try to reverse the payment via his bank. If this is not successful, the beneficiary’s bank must hand over the contact details of the account holder (upon request). The person who has been defrauded can try to recover his money through criminal proceedings.

For the banks, the SEPA name check initially means an implementation effort in online banking and in the core banking system. Greater savings are conceivable if the processing effort for incorrect transfers is reduced because fewer incorrect transfers occur.

An additional use case for the SEPA name check will arise for companies that currently use an Account Information Service (AIS) in accordance with PSD2 or a 1-cent credit transfer (a confirmation code is then included in the remittance information). These methods can be used to check whether the user also has access to an account or has copied the IBAN somewhere. Requesting account access data from the AIS is often a high hurdle, even for honest customers. The procedure with the 1-cent transfer does not fare much better in terms of acceptance. With the SEPA name check, an “account check light” is created as a side effect.

Are you looking for a solution for SEPA name verification according to Verification of Payee?

If you are looking for a Verification of Payee solution like CPG.vop for your company, we look forward to hearing from you here.

Share