An article by

Dr. Martin Berger

Published on

27/10/2021

Updated on

01/11/2023

Reading time

5 min

Table of content

It’s been another two months, unbelievable! It is therefore time for us to take another look at the distribution and participation in SEPA Instant by consumers and banks. As usual, we analyze public data from the European Central Bank (ECB) and from EBA Clearing (EBA stands for Euro Banking Association).

As a reminder: our contribution SEPA Instant Credit Transfer: Transfers up to € 100K in 10 seconds explains the essential properties of SCT Inst scheme.

The following can be summarized in October 2021:

- Almost 10% of all SEPA credit transfers are now carried out as instant credit transfers.

- 25% of all BIC bank codes in the SEPA area are connected to instant payment.

- 23 additional financial institutions have been registered as SCT Inst participants since August 2021.

- The linear increase in SCT Inst transaction volume and SCT Inst amount volume recorded on the basis of data from EBA Clearing continues in October 2021.

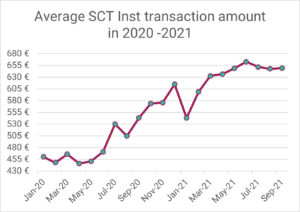

- The average transaction amount for a SEPA instant credit transfers ranges currently around € 655.

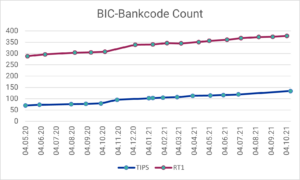

- The number of TIPS or RT1 participants (measured in BIC bank codes) continues to grow steadily in a linear fashion. The latest numbers could indicate that the TIPS growth slightly accelerates.

In the remainder of the article there are detailed analyzes with corresponding graphics.

SEPA Instant: Comparison of SCT Inst vs. SCT availability in the SEPA area

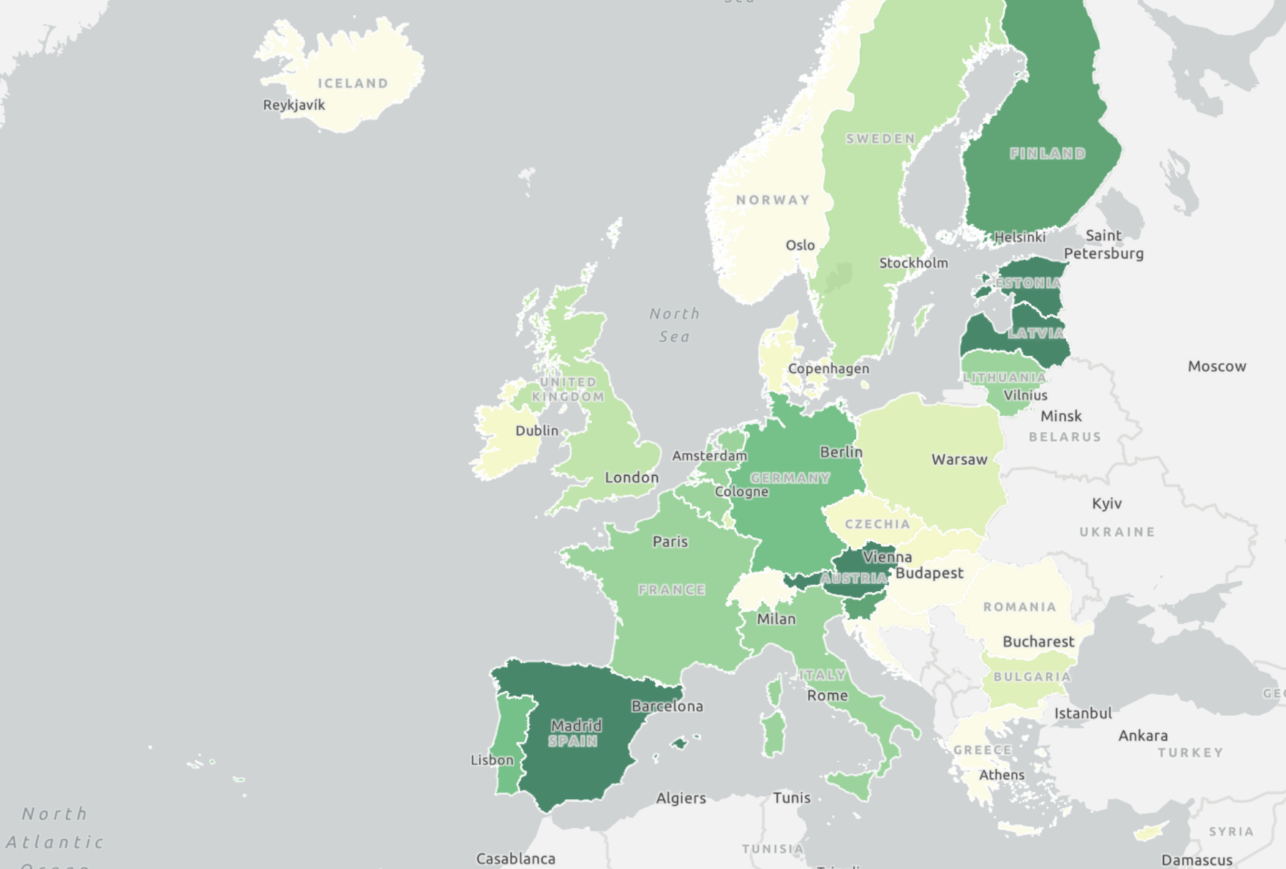

This map of the SEPA area shows the percentage comparison of the number of SCT Inst participating BIC bank codes to the classic SCT participating BIC bank codes.

Based on the data from ECB from October 12th, 2021, from EBA Clearing from October 5th, 2021 and the Bundesbank’s directory of available payment service providers as of October 18th, 2021, the percentage of SCT-participating payment service providers (measured using their BIC bank codes) is set in relation to those that have also opted for SEPA Instant participation in the SEPA countries. The data on which the map is based are listed in the following table:

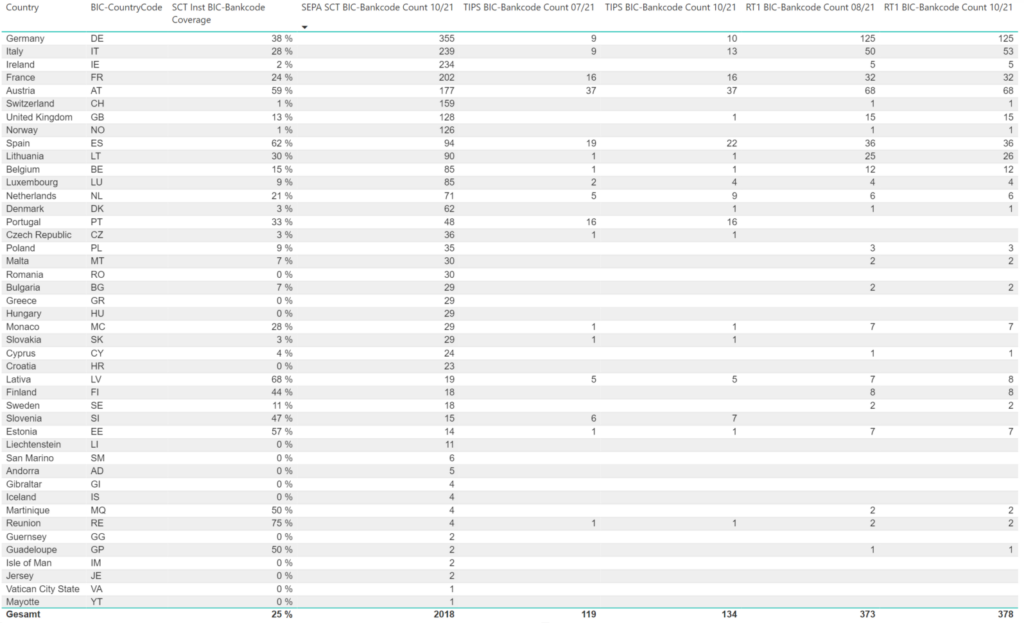

Percentage comparison of SCT Inst vs. SCT participation of the listed BIC bank codes per SEPA country, as well as their participation in TIPS or RT1 in comparison between July/August and October 2021.

Latest statistics from ECB and EBA Clearing

Statistics from ECB

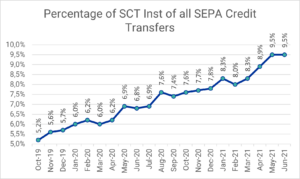

The following graphic shows the percentage of SEPA instant transfers compared to all SEPA transfers that were processed in the months of October 2019 to June 2021. In the meantime, almost 10% has been achieved, a doubling in last 21 months.

Percentage of instant transfers in all SEPA transfers (Data source: ECB)

Statistics from EBA Clearing

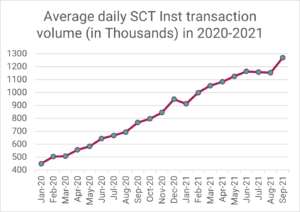

The following figure shows the average daily SEPA Instant transaction volume processed via RT1 from January 2020 to September 2021. An almost linear increasing trend can still be seen here.

SEPA Instant via R1: Average daily SCT Inst transaction volume in 2020-2021 (data source: EBA Clearing)

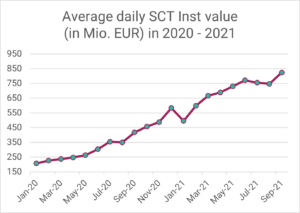

The following figure shows the average daily SEPA Inst volume in EUR million processed via RT1 from January 2020 to September 2021. As expected, a similarly increasing trend can be seen here as well.

SEPA Instant via R1: Average daily SEPA SCT Inst value in EUR million in 2020-2021 (data source: EBA Clearing)

The following figure shows the average transfer amount for instant transfers for the period from January 2020 to September 2021. After increasing the transaction limit from EUR 15,000 to EUR 100,000 on July 1, 2020, has a stable average transfer amount been reached? We will keep watching …

SEPA Instant via R1: Average transfer amount in 2020-2021 (data source: EBA Clearing)

SEPA Instant: Number of BIC bank code participants in TIPS and RT1

The following figure shows the number of BIC bank codes participating in TIPS and RT1 in the period from May 2020 to October 2021. Is the increase in participating TIPS BIC bank codes accelerating? The next few months will show this.

SEPA Instant: Number of BIC bank codes connected to TIPS or RT1 in the period May 2020 – October 2021 (data sources: EZB, EBA Clearing)

SEPA Instant: Change in participants since August 2021

New TIPS participants since August 2021 are:

| Number | Institute (BIC-Bankcode) |

Type | Country |

|---|---|---|---|

| 1 | Posojilnica Bank eGen – | Reachable Party – | AT |

| 2 | BANKING CIRCLE S.A. – GERMAN BRANCH (SXPY) – | Reachable Party – | DE |

| 3 | BANKING CIRCLE DENMARK (SXPY) – | Reachable Party – | DK |

| 4 | ARQUIA BANK S.A. – | Reachable Party – | ES |

| 5 | BANCO PICHINCHA – | Reachable Party – | ES |

| 6 | UNICAJA BANCO, S.A. – | TIPS Participant – | ES |

| 7 | BANKING CIRCLE UK (SAPY) – | Reachable Party – | GB |

| 8 | BANCA DI CREDITO POPOLARE – | TIPS Participant – | IT |

| 9 | LA CASSA DI RAVENNA S.P.A. – | TIPS Participant – | IT |

| 10 | BANCA DI IMOLA S.P.A. – | Reachable Party – | IT |

| 11 | BANQUE ET CAISSE D’EPARGNE DE L’ETAT – | TIPS Participant – | LU |

| 12 | BANKING CIRCLE S.A. (BCIR) – | TIPS Participant – | LU |

| 13 | DE VOLKSBANK N.V. (ASNB) – | Reachable Party – | NL |

| 14 | BLG WONEN – | Reachable Party – | NL |

| 15 | DE VOLKSBANK N.V. (RBRB) – | Reachable Party – | NL |

| 16 | DE VOLKSBANK N.V. (SNSB) – | TIPS Participant – | NL |

| 17 | DELAVSKA HRANILNICA D.D. LJUBLJANA – | TIPS Participant – | SI |

The Austrian CAPITAL BANK – GRAWE GRUPPE AG left as TIPS participant since August 2021.

New RT1 participants since August 2021 are:

| Number | Institute | Country |

|---|---|---|

| 1 | BANCA GENERALI S.p.A. – | IT |

| 2 | Carifermo – cassa di risparmio di Fermo s.p.a. – | IT |

| 3 | BANCA POPOLARE DEL CASSINATE – | IT |

| 4 | CONNECTPAY UAB – | LT |

| 5 | BALTIC INTERNATIONAL BANK SE – | LV |

Our data sources

Here we evaluate the current status of participation in instant payment with public data from the European Central Bank and EBA Clearing from May 2020 to October 2021.

Further information on SEPA Instant Payments

This article is part of a series on instant payment and builds on these articles:

- Instant Payments in SEPA: How widespread is that in August 2021?

- Instant SEPA Payments: Current figures from June 2021

- SEPA Credit Transfer Instant: Analysis of the adoption in April 2021

- Instant Payment System: News and insights from February 2021

- SEPA Instant Payments: News and insights from December 2020

- Instant Payment: News and insights from October 2020

- SCT Instant Payment: participation analysis within SEPA area (August 2020)

- SEPA Instant Credit Transfer Register of Participants: a data analysis (June 2020)

Do you want to find out more?

Among other things, we offer a high-performance software solution CPG.instant for processing SCT Inst transfers. If you have any questions or suggestions or you are interested in the topic of payment transactions, instant payment and related software products, please do not hesitate to contact us.

Share