An article by

Dr. Martin Berger

Published on

16/04/2021

Updated on

01/11/2023

Reading time

5 min

Table of content

SEPA Credit Transfer Instant: Status of the adoption in April 2021

Using public data from the ECB and EBA Clearing, we analyze the situation with the adoption of SEPA Credit Transfer Instant (SCT Inst) by banks and financial institutions (identified by their BIC or BIC bank code), especially from an interbank perspective . The following article covers the following topics in detail:

- Our analysis clearly shows that the breakdown of SCT Instant to SCT with an average of 23% in the entire SEPA area can still be significantly expanded, but that an increase from 19% in October 2020 can be recorded here as well.

- Since February 2021, 14 additional financial institutions have been registered as SCT Inst participants, as well as one departure.

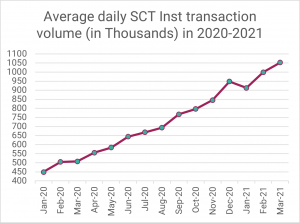

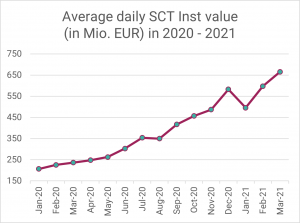

- In the last 15 months, EBA Clearing has recorded an almost linear increase in SCT Inst transaction volume and SCT Inst amount volume. The average daily transaction volume more than doubled during this period, and the average daily amount more than tripled.

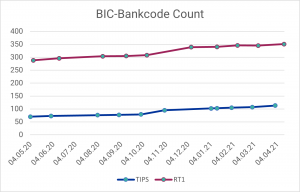

- The TIPS or RT1 subscriber numbers (measured in BIC bank codes) continue to grow slowly but steadily for TIPS and RT1.

SEPA Credit Transfer Instant: Shortly explained

We briefly describe the essentials of the SEPA Credit Transfer Instant in the article SEPA Instant Credit Transfer: Transfers up to € 100K in 10 seconds.

What data do we analyze?

Here we analyze the status quo of SEPA Credit Transfer Instant with the help of public data from May 2020 to April 2021 of the European Central Bank (ECB) and EBA Clearing (EBA stands for Euro Banking Association), which are published monthly by these institutions. We specifically evaluate which financial institutions participate in instant payments via which bank identifier code (BIC) or which BIC bank code.

Why the reference to these sources? The ECB and EBA Clearing both offer clearing and settlement mechanisms (CSM) for SEPA Instant Payments and therefore report regularly on their participating institutions. The ECB offers the Target Instant Payment Settlement (TIPS) service for instant payments, while EBA Clearing offers the RT1 service.

SEPA Credit Transfer Instant: Comparison of SCT Inst vs. SCT availability in the SEPA area

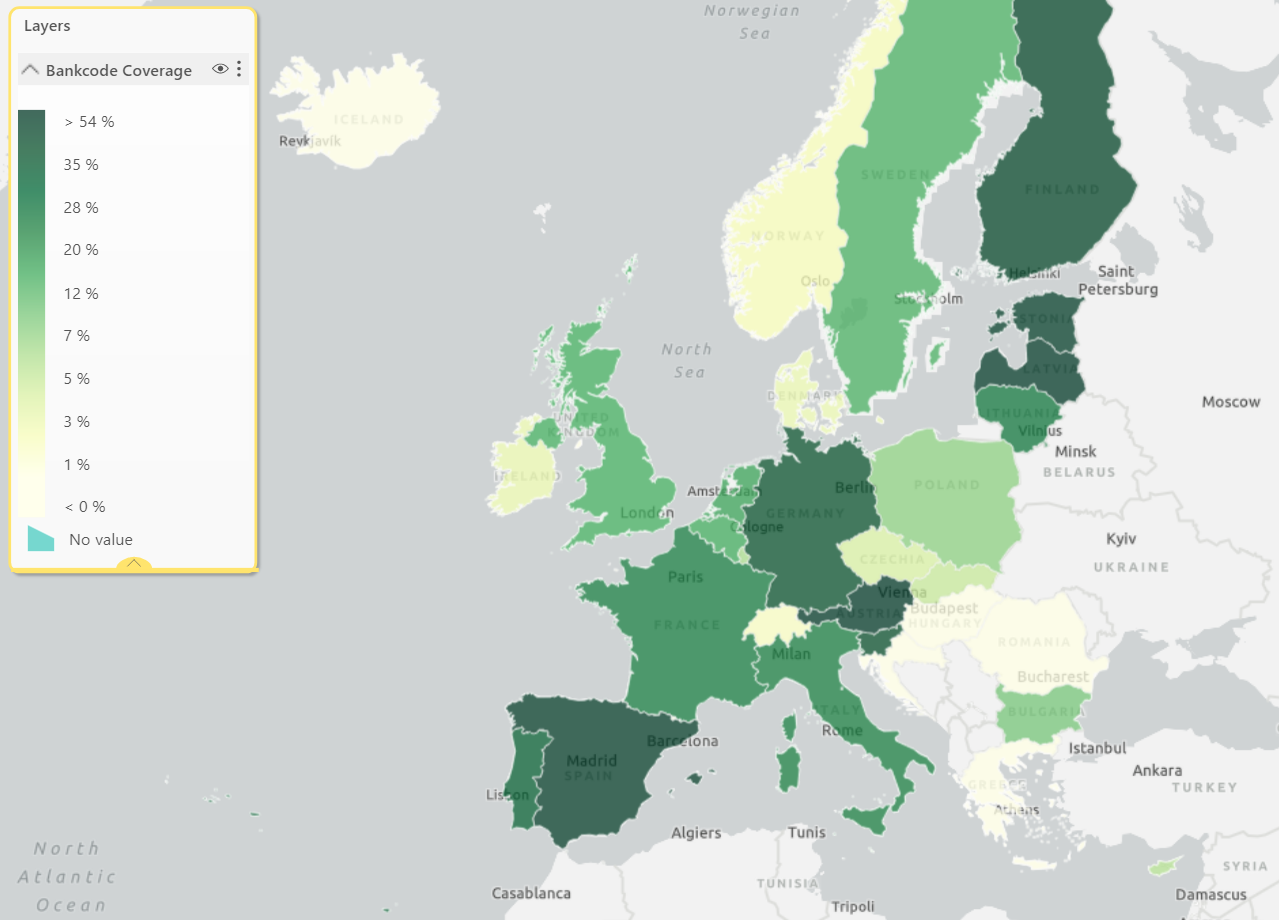

This map of the SEPA area shows the percentage comparison of the number of SCT Instant participating BIC bank codes to the classic SCT participating BIC bank codes.

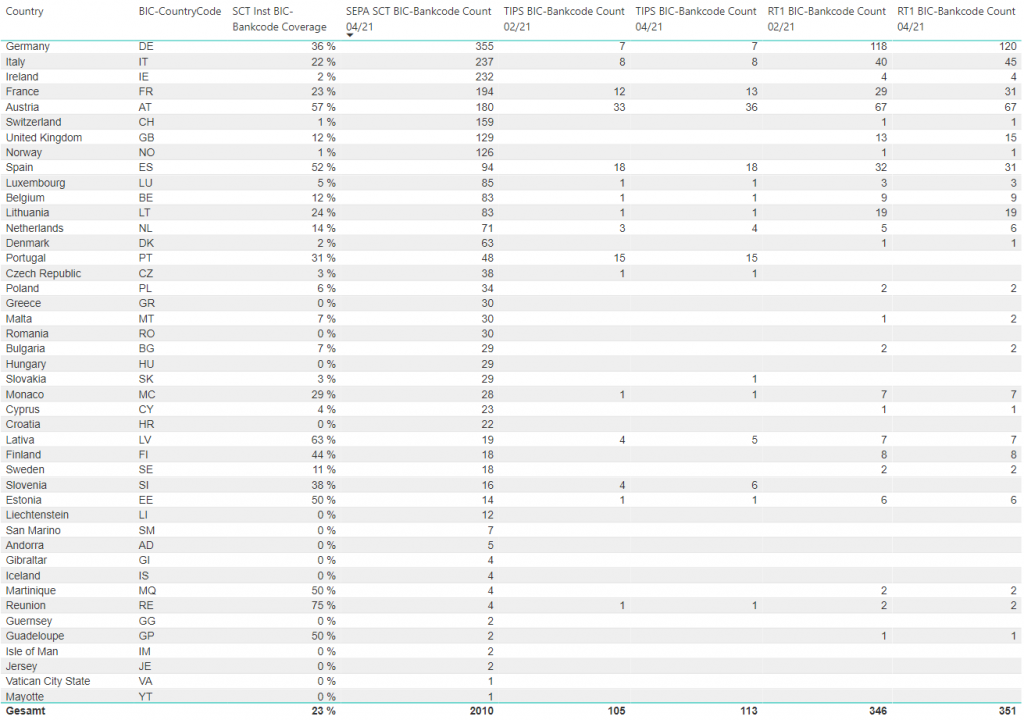

Based on the data from ECB from April 1st, 2021, from EBA Clearing from April 13th, 2021 and the Bundesbank’s directory of available payment service providers as of April 12th, 2021, the percentage of SCT-participating payment service providers (measured using their BIC bank codes) is analyzed which have also opted for SCT Instant participation in the SEPA countries. The data on which the map is based are listed in the following table:

Percentage comparison of SCT Inst vs. SCT participation of the listed BIC bank codes per SEPA country, their participation in TIPS or RT1 in comparison between February and April 2021.

It clearly shows that the breakdown from SCT Instant to SCT with an average of 23% in the entire SEPA area can still be significantly expanded, but that an increase from 19% can be recorded since October 2020 (compare Instant Payment: News and insights from October 2020).

New SEPA Credit Transfer Instant participants since February 2021

New TIPS participants since February 2021 are:

- Banka Sparkasse D.D. (Slovenia)

- Bankhaus Schelhammer and Schattera AG (Austria)

- Bunq B.V. (Netherlands)

- Gorenjska Banka D.D., Kranj (Slovenia)

- Hypo-Bank Burgenland AG (Austria)

New TIPS reachable parties since February 2021 are:

- Banque Palatine (France)

- Capital Bank – Grawe Gruppe AG (Austria)

- Regionala Investiciju Banka (Latvia)

New RT1 participants since February 2021 are:

- Banca Cambiano 1884 spa (Italy)

- Banca Popolare di Lajatico (Italy)

- Banca Popolare Pugliese (Italy)

- Istituto Bancario del Lavoro S.p.A. (Italy)

- OpenPayd Financial Services Malta Limited (Malta)

- Payoma Limited (UK)

No longer listed as RT1 participant since February 2021: Ebury Partners UK Limited in Madrid (Spain)

Statistics on the use of EBA clearing

The following figure shows the average daily SEPA Credit Transfer Instant transaction volume processed via RT1 from January 2020 to March 2021. An almost linear increasing trend can be clearly seen here.

SEPA Credit Transfer Instant via R1: Average daily SCT Inst transaction volume in 2020-2021 (data source: EBA Clearing)

The following figure shows the average daily SEPA Inst volume in EUR million processed via RT1 from January 2020 to March 2021. As expected, a similar increasing trend can also be clearly seen here, the volume has more than tripled in the last 15 months.

SEPA Credit Transfer Instant via R1: Average daily SEPA SCT Inst volume in EUR million in 2020-2021 (data source: EBA Clearing)

Number of BIC bank code participants in TIPS or RT1

The following figure shows the number of BIC bank codes participating in TIPS or RT1 in the period from May 2020 to April 2021. A slowly increasing trend can still be seen here, although the increase in the SCT Inst transaction volume (see above) is more likely due to an adoption of SCT Inst can explain transactions within the participating banks than through more SCT Inst participants per se.

SEPA Credit Transfer Instant: Number of BIC bank codes connected to TIPS or RT1 in the period May 2020 – April 2021 (data sources: ECB, EBA Clearing)

SEPA Credit Transfer Instant: Other news

This article is part of a series on SEPA Instant Payments and builds on these articles:

- Instant Payment System: News and insights from February 2021

- SEPA Instant Payments: News and insights from December 2020

- Instant Payment: News and insights from October 2020

- SCT Instant Payment: participation analysis within SEPA area (August 2020)

- SEPA Instant Credit Transfer Register of Participants: a data analysis (June 2020)

In the following analyzes, we will observe the monthly changes and further deepen the evaluation of the spread of SEPA Instant Payments in the SEPA area.

Contact

Among other things, we offer a software solution CPG.instant for processing SCT Inst. If you have any questions, suggestions or interests about payment transactions, SEPA Instant Payments and corresponding software products, please do not hesitate to contact us:

- By phone: +49 (0) 89 6809700

- Email: infocpg@cpg.de

Share