An article by

Andreas Wegmann

Published on

01/08/2024

Updated on

28/08/2024

Reading time

3 min

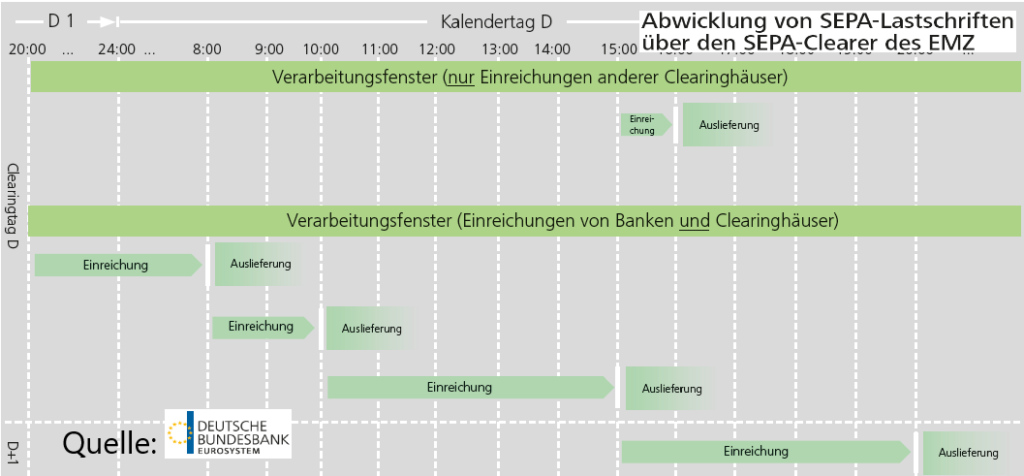

Retail payment transactions generally are not handled as single transactions but with bulk files. Corporates in the SEPA area submit payments to their house bank in pain messages. This XML structure allows the creation of so-called bulks, i.e. a large number of payments can be transmitted in a structured manner. The SEPA Bank converts the format into pacs.008 messages and sends them “into clearing”. The SEPA Clearer of the Bundesbank accepts up to 100,000 transactions with a value of up to € 999,999,999.99 per bulk, whereby up to 999 bulks can be packed into one physical file.

The Instant Payment Regulation puts real-time payments on an equal footing with conventional credit transfers (SEPA Credit Transfer – SCT), i.e. companies may also submit SEPA Instant Payments (SCT Inst) in bulk. SCT Inst bulk processing is therefore important for banks with corporate customer business.

SEPA Instant Payments for Corporate Customers

As far as the EU’s motivation for the Instant Payment Regulation can be read, corporate customers were not the focus of the initiative. In fact, the regulation makes no distinction between private and corporate customers, but refers to “payment service users” in general.

As far as the EU’s motivation for the Instant Payment Regulation can be read, corporate customers were not the focus of the initiative. In fact, the regulation makes no distinction between private and corporate customers, but refers to “payment service users” in general.

In principle, banks must offer every service they offer for SCT in the same way for SCT Inst, and it is to be expected that companies will take advantage of these opportunities. In the corporate customer business, banks must adapt their services to the new requirements:

- SCT Inst payments must not be more expensive than conventional transfers,

- It must be possible to submit payments in bulk as with SCT,

- SCT Inst Bulks must be processed just as quickly as SCT Inst single transactions,

- Verification of Payee must be carried out,

- currency accounts can also be used and

- there must be an active confirmation of the execution of each individual payment.

The most obvious advantage for companies when using real-time payments is the simple time control, as neither weekends nor public holidays need to be taken into account. Paying on time is therefore much easier for companies.

Time Stamp for SCT Inst Bulk Processing

The specified time of 10 seconds for processing an SCT Inst payment is of course more difficult to meet for bulk files than for individual transactions. A bank must unpack the bulk and check the executability of each individual transaction. These checks, such as the account coverage or the availability of the recipient, must be carried out within the time period, as the time stamp for the transaction must be set immediately after unpacking the bulk. There is an exception for currency accounts: here the time stamp may only be set from the moment of conversion.

Even when using accompanying documents or the “Distributed Electronic Signature” with EBICS, the time only runs after the payments have been released.

Verification of Payee and Time Stamp

Corporate customers can dispense with the Verification of Payee (VOP) procedure and will probably do so when submitting bulks. However, the bank must offer VOP and therefore also have a solution ready for processing. For example, the bank and the corporate customer must find a way to deal with “no match” or “partial match” transactions. Since the Verification of Payee is always carried out before a payment is made, this process does not count towards the SCT Inst timeframe, but the processing of SCT Inst Bulk files is subject to further complexity.

If you are interested in a solution for processing SEPA Instant Payment transactions, we look forward to hearing from you here.

Share