An article by

Andreas Wegmann

Published on

17/02/2022

Updated on

17/02/2022

Reading time

3 min

Regardless of whether a payment is made as a credit transfer (SEPA credit transfer) or as a direct debit (SEPA direct debit), it often takes a different amount of time for it to reach the recipient. How such different runtimes can come about is explained in this article.

SEPA payment transactions in real time?

While everyone is talking about real-time payments, they are by far the exception. Most of the world’s payment traffic, including that of the Eurosystem, is designed to process batch files in processing cycles. The reason for this is not only the (lack of) performance of the IT systems, but also has very practical reasons. For example, batch processing results in the possibility of prioritization: a bank first processes the incoming payments for the accounts and then the outgoing payments. In this way, the accounts will be covered as far as possible in order to be able to make outgoing payments at the next moment.

In a real-time booking system, the following can happen:

- Account balance at 12:00 p.m. = €700

- Direct debit for rent 12:05 p.m. over 800 will be rejected due to insufficient funds

- Receipt of payment salary 12:10 p.m. of €2,000; new account balance €2,700

Of course, a bank must have mechanisms in place to prevent this from happening. A bank customer will hardly understand if the direct debit for his rent “bursts”, although there is obviously a lot of money in the account.

The clearing systems also usually do not work in real time, because it makes a similar difference when incoming and outgoing payments are processed. A bank with low liquidity could otherwise be tempted to process all incoming payments immediately, but the outgoing payments as late as possible. There are also precautions in the clearing systems to prevent such unilateral taking of advantages.

In the euro area, only the so-called SEPA Instant Payments are processed in real time, e.g. via TIPS.

Which factors determine the SEPA payment runtime?

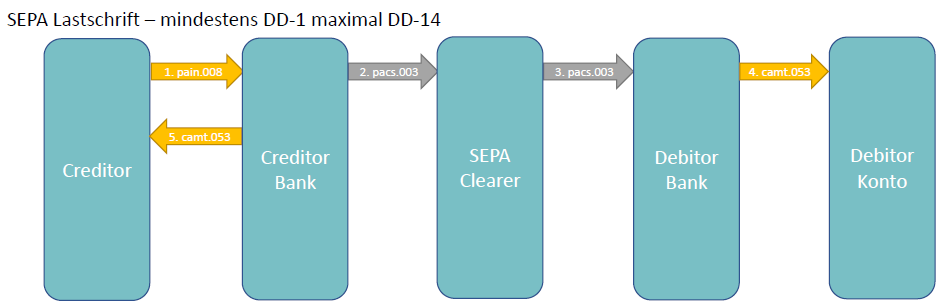

The answer to this question is: it depends. First of all, the type of transaction is important. The direct debit transaction (SDD CORE) is shown in the image, which can be send by the debtor bank one day after submission at the earliest. This restriction does not apply to SCT. Furthermore, the processing times of the stations involved determine the duration of a SEPA payment. Even in the simple case of a national SEPA payment, at least three stations are involved: the creditor bank, the clearing system and the debtor bank.

The answer to this question is: it depends. First of all, the type of transaction is important. The direct debit transaction (SDD CORE) is shown in the image, which can be send by the debtor bank one day after submission at the earliest. This restriction does not apply to SCT. Furthermore, the processing times of the stations involved determine the duration of a SEPA payment. Even in the simple case of a national SEPA payment, at least three stations are involved: the creditor bank, the clearing system and the debtor bank.

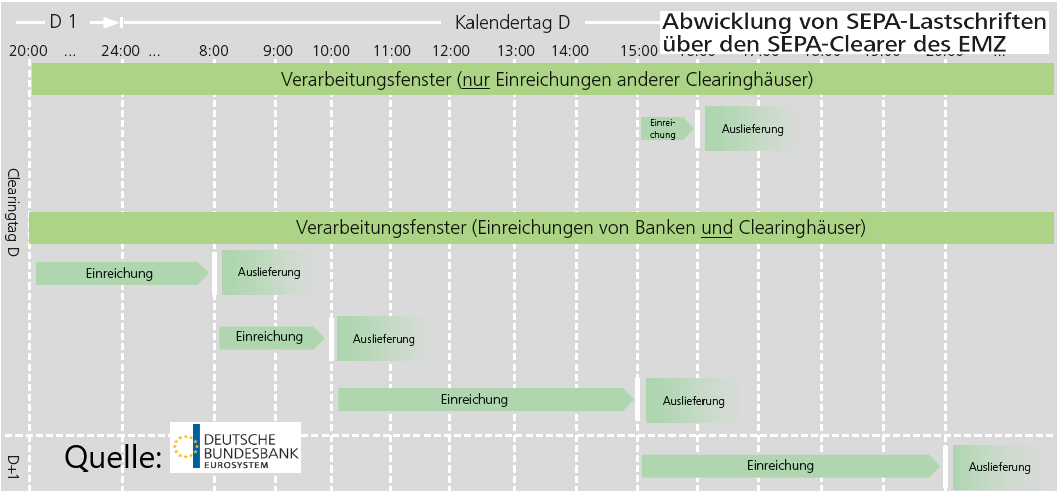

Our example shows the Bundesbank’s clearing system for retail payments (elektronischer Massenzahlungsverkehr – EMZ), the so-called SEPA Clearer. The nature of this CSM is to process only transactions without priority and it has several processing cycles per day.

If the direct debit arrives at the SEPA clearer after 8:00 p.m., it will not be delivered until the next day, i.e. sent to the debtor’s bank. The prerequisite, however, is that these are operating days of the SEPA Clearer. There is no processing on weekends or public holidays. Even if the systems of the creditor and debtor bank work in real time, the processing time of a transaction can be extended because of the clearing system.

Why is the SEPA payment runtime sometimes very short?

There are also clearing systems in the euro zone, such as CENTROlink, which work in real-time. If the creditor and debtor bank also do this, a SEPA transaction is almost always carried out in real time.

Very often, the sender and recipient have their accounts with the same bank or banking group, e.g. the savings bank group. Such SEPA transactions are then processed internally and are usually executed almost immediately.

Share