Published on

17/11/2020

Updated on

17/11/2020

Reading time

2 min

Table of content

Refueling without having to queue at the cash register is a dream for all drivers in a hurry. With Request to Pay, this can be done easily, without a card reader and without a customer loyalty program (such as Shell smart pay).

Request to Pay – how does it work at a self service gas station?

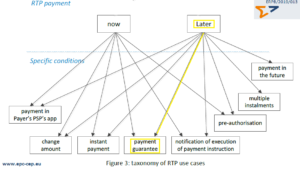

An RTP transaction can be carried out in different variations. In a self-service situation with an unknown final amount, the variant with the payment guarantee is suitable. In this example at the gas station, the gas pump is only released if the customer has confirmed to a payment guarantee in his banking app. At the end of the refueling, the known amount is transferred to the merchants bank account by SEPA credit transfer (SCT or SCT Inst).

In this example at the gas station, the gas pump is only released if the customer has confirmed to a payment guarantee in his banking app. At the end of the refueling, the known amount is transferred to the merchants bank account by SEPA credit transfer (SCT or SCT Inst).

SEPA Proxy Lookup and SEPA Request to Pay

Like always with a RTP transaction, the IBAN of the buyer must first be transmitted to the merchant so that he can initiate the transaction with the merchants bank. The possibilities for this are countless, from manual input, SMS, QR codes, to contactless transmission with bluetooth, NFC or any other current standard. The SEPA Proxy Lookup (SPL) is ideal in order to reach as many users as possible and to create as few hurdles as possible for technical requirements. A simple, timeless phone call is sufficient here. The process is then very easy for the buyer and absolutely safe for the seller:

- Drivers dial the phone number at the pump with their cell phone

- the telephone system recognizes the calling number and forwards it to the billing system of the petrol station

- the accounting system asks for the IBAN with an SPL request

- the billing system initiates an RTP (with payment guarantee)

- the driver confirms the request in his banking app

- the pump is released

- After the refueling process, there is an automatic transfer to the merchants bank account

Self-Service Machines (unattended Machines)

RTP can be easily implemented at any self-service situations. There are no costs for an expensive (because it is vandal-proof) card terminal or cash deposit device. So there no risk of fear machine break-ins too.

Fraud is also ruled out because only an IBAN account holder with access to his banking app can initiate a transaction.

In the case of a vending machine, a credit can first be approved via RTP and goods can be selected on the device – with a vandal-proof keyboard.

Alternatively, the different goods can be selected with their “own telephone number”. The billing system must then of course have a telephone system with appropriate extensions.

Share