Published on

05/07/2024

Updated on

05/07/2024

Reading time

3 min

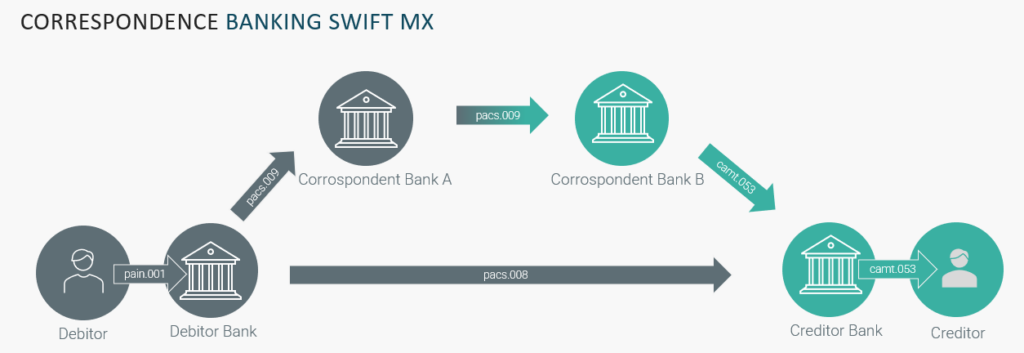

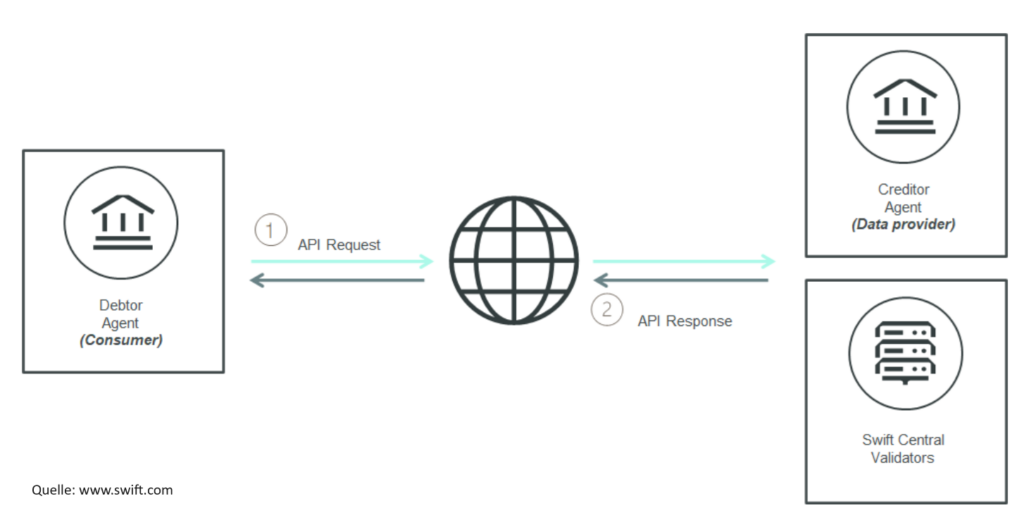

With the obligation for SEPA banks to use the Verification Of Payee Scheme (formerly known as the “IBAN name check”), the ECB has created the possibility of checking certain details in advance of a payment. Although there is no obligation to do so in international payment transactions, SWIFT has already established the technical possibilities with the Payment Pre-validation Service. Before the actual transaction via pacs.008 or pacs.009, checks can be carried out via an API.

SWIFT Payment Pre-validation vs. SEPA Verification Of Payee

The verification of payment data before a transaction is initiated is intended to prevent so-called APP fraud (Authorised Push Payment Fraud) in the SEPA Verification Of Payee (VOP). In the area of correspondent banking, the application is more far-reaching, which is why the comparison between these systems is not as accurate. Typically, the sending and receiving banks in correspondent banking systems do not have a direct business relationship and therefore have little knowledge of each other. The SWIFT Payment Pre-validation Service helps to prevent payments from being rejected due to incorrect information or the status of the account (expired, blocked) at the receiving bank.

The verification of payment data before a transaction is initiated is intended to prevent so-called APP fraud (Authorised Push Payment Fraud) in the SEPA Verification Of Payee (VOP). In the area of correspondent banking, the application is more far-reaching, which is why the comparison between these systems is not as accurate. Typically, the sending and receiving banks in correspondent banking systems do not have a direct business relationship and therefore have little knowledge of each other. The SWIFT Payment Pre-validation Service helps to prevent payments from being rejected due to incorrect information or the status of the account (expired, blocked) at the receiving bank.

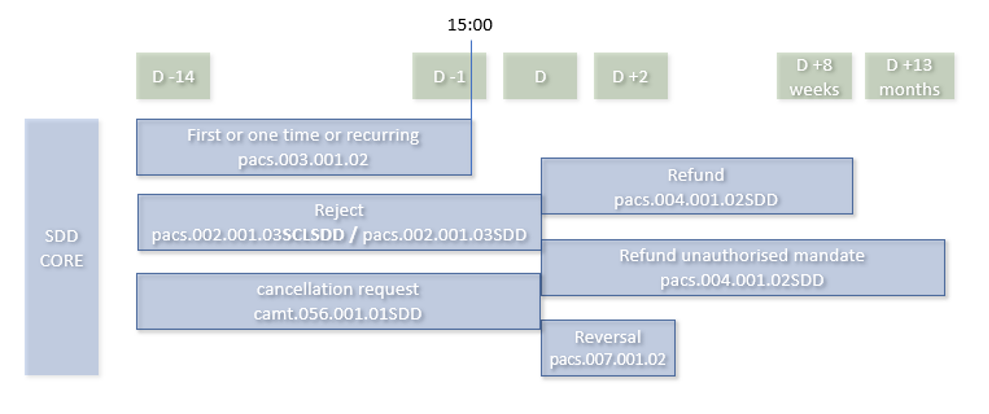

Such rejections of payments are not critical in SEPA clearing, as the clearing systems have corresponding automatisms. Between correspondent banks, especially if there are several banks in the transaction chain, a reversal is usually much more complex.

Avoiding r-transactions is also a reason for another important feature of SEPA VOP: PPV is not a one-way street, i.e. the receiving bank can make queries about the transaction in order to ensure correct allocation or the legality of a transaction.

The SWIFT PPV Service thus reduces the number of rejected transactions, the associated costs for the banks involved and the frustration of the account holders. SWIFT Payment Pre-validation is therefore an important contribution to the efficiency of the correspondent banking system.

One disadvantage of the service is that there is of course no obligation to participate. It remains to be seen how utilisation will develop.

Die Payment Pre-validation API

The PPV service is accessible to participating banks via SWIFT’s own API, which is provided both via the SWIFT Multi-Vendor Secure IP Network (MV-SIPN) and on the Internet. One version of the Payment Pre-validation API is intended for use by account holders (Payment Pre-validation Consumer API). In addition to checking the availability of the receiving account, other criteria can be checked, e.g:

Payment Purpose Code and Payment Purpose In some countries this information is mandatory.

Amount and Account Format Some currencies only allow or prescribe a certain number of decimal places.

Category Purpose The category of payment may have to be authorised for the receiving account.

Financial Institution Identity Check that the receiving institution is listed in SwiftRef.

SwiftGo Eligibility If the payment fulfils the eligibility requirements of the SwiftGo regulations, information on the processing time and fees can be obtained.

Payment Instruction und Contextual Payment Various details on the currency corridor and country requirements can be validated in advance.

The participating banks must of course ensure that they do not violate the data protection requirements in their country.

If you have any questions about the SWIFT Payment Pre-validation Service, we look forward to hearing from you here.

Share