An article by

Dr. Martin Berger

Published on

21/10/2022

Updated on

09/11/2023

Reading time

3 min

Table of content

At the end of October 2022, we will once again evaluate the pan-European reachability of instant payments in the SEPA area, analyze the current participation of financial institutions and payment service providers and thus assess in particular the relevance of instant credit transfers in interbank payment transactions. As background information for more in-depth information, you will find the essential features of SEPA instant credit transfers in our article SEPA Instant Credit Transfer: Transfers up to € 100K in 10 seconds.

Highlights from October 2022 briefly summarized

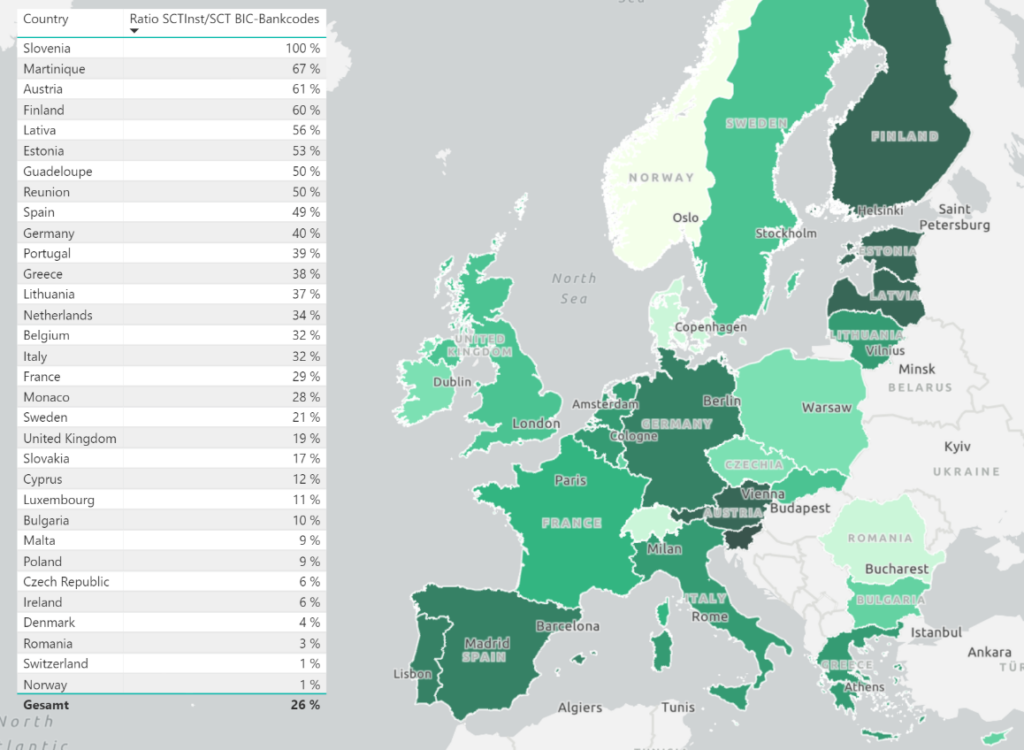

- The proportion of SCT participants in the entire SEPA area who are also SCTInst participants has grown by 1% to 26% in the last 2 months.

- In Austria at 10%, in Estonia at 6% and in Sweden at 5%, this proportion has grown particularly strongly in the last two months.

- According to a post by the European Payments Council, the first Croatian payment service provider will participate in SEPA Instant Payments in July 2023.

Pan-European reachability of instant payments: Comparison of SCT Inst vs. SCT implementation in the SEPA area

Based on the data from ECB, from EBA Clearing and the Bundesbank’s directory of available payment service providers, the total number of payment service providers participating in SCT in the SEPA countries (measured using their BIC bank codes) is set in relation to the number of those opted for SEPA Instant implementation. The following overview shows the BIC bank code count per country for SCT Inst in relation to SCT for the countries of the SEPA area.

To explain the key figure Ratio SCTInst/SCT BIC-Bankcodes:

- A ratio of 100% for a country means that all SCT participating BIC bank codes also participate in SCT Inst.

- A ratio of 0% for a country means that no SCT participating BIC also participates in SCT Inst.

Pan-European reachability of instant payments: Ratio of the number of SCT Instant participants to SCT (counted by unique BIC bank codes) per SEPA country in October 2022.

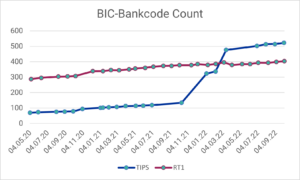

Pan-European reachability of instant payments: Number of BIC bank code participants in TIPS and RT1

The following figure shows the number of BIC bank codes participating in TIPS and RT1 in the period from May 2020 to October 2022:

Pan-European reachability of instant payments: Number of BIC bank codes connected to TIPS or RT1 in the period May 2020 – October 2022 (data sources: EZB, EBA Clearing)

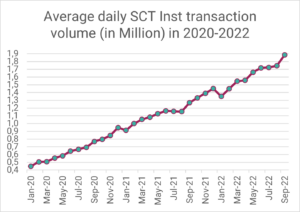

Current transaction statistics of EBA Clearing

The figure below shows the average daily SEPA Instant Payment transaction volume processed via RT1 from January 2020 to September 2022:

Pan-European reachability of instant payments: Average daily SCT Inst transaction volume in 2020-2022

Are you as a bank interested in software solutions for pan-European reachability of instant payments?

CPG.instant as a software solution for connecting core banking systems to TIPS or RT1 in interbank payments

Among other things, we offer high-performance software solutions for processing SCT Inst transfers, which allow your bank to flexibly connect one or more core banking systems and clear SEPA instant payments accordingly via interfaces to TIPS or RT1.

If you have any questions or suggestions or you are interested in the topic of payment transactions, instant payment and related software products, please do not hesitate to contact us.

This article is part of a bi-monthly series and appears in our blog category on SEPA instant payments.

External data sources:

- ECB TIPS facts (03.10.2022)

- EBA Clearing RT1 participants (04.10.2022)

- Bundesbank Verzeichnis der erreichbaren Zahlungsdienstleister (03.10.2022)

Share