An article by

Andreas Wegmann

Published on

21/10/2024

Updated on

23/01/2025

Reading time

3 min

SEPA direct debit (SDD) is a very popular payment method in Germany with more than 20 billion transactions per year. With the“Instant Payments Regulation” (IPR), Verification of Payee (VOP) is also being introduced for direct debits. What means additional work for banks can be quite advantageous for companies. This article describes the advantages of VOP information for direct debits for online merchants.

SEPA direct debit payments in German E-Commerce Business

German customers are used to the direct debit procedure because electricity, telecommunications, insurance, rents etc. are usually collected by direct debit. In online commerce, the procedure offers the highest possible protection for the customer, as a direct debit from their bank can be cancelled without justification. The bank reverses the transaction and the retailer has to take civil action to recover the money. Online retailers therefore take a critical view of the procedure because the effort involved in “chasing the money” rarely makes economic sense. However, compared to card payments, Klarna, PayPal etc., direct debit is very cost-effective. It is therefore often worthwhile for online retailers to minimise the chargeback risk with various checks and thus maintain a balance between cost efficiency and risk. Companies such as creditPass GmbH have a whole arsenal of checking options to help online merchants with direct debit processing.

German customers are used to the direct debit procedure because electricity, telecommunications, insurance, rents etc. are usually collected by direct debit. In online commerce, the procedure offers the highest possible protection for the customer, as a direct debit from their bank can be cancelled without justification. The bank reverses the transaction and the retailer has to take civil action to recover the money. Online retailers therefore take a critical view of the procedure because the effort involved in “chasing the money” rarely makes economic sense. However, compared to card payments, Klarna, PayPal etc., direct debit is very cost-effective. It is therefore often worthwhile for online retailers to minimise the chargeback risk with various checks and thus maintain a balance between cost efficiency and risk. Companies such as creditPass GmbH have a whole arsenal of checking options to help online merchants with direct debit processing.

SEPA Verification of Payee in E-Commerce Business

Gem. IPR müssen Banken Ihren Geschäftskunden

offer a VOP query (also) for direct debits in future, without being allowed to charge an additional fee for this. It therefore makes sense to make use of this service. When checking out in the online shop, retailers usually offer their customers various payment methods. If the customer chooses direct debit, a Verification of Payee can be carried out in future. If the buyer’s name also matches their IBAN and the delivery is also to be made under this name, the risk of fraud is low.

Gem. IPR müssen Banken Ihren Geschäftskunden

offer a VOP query (also) for direct debits in future, without being allowed to charge an additional fee for this. It therefore makes sense to make use of this service. When checking out in the online shop, retailers usually offer their customers various payment methods. If the customer chooses direct debit, a Verification of Payee can be carried out in future. If the buyer’s name also matches their IBAN and the delivery is also to be made under this name, the risk of fraud is low.

A VOP query is no guarantee that the account will be covered by direct debit, but it does provide additional security that the buyer is honest.

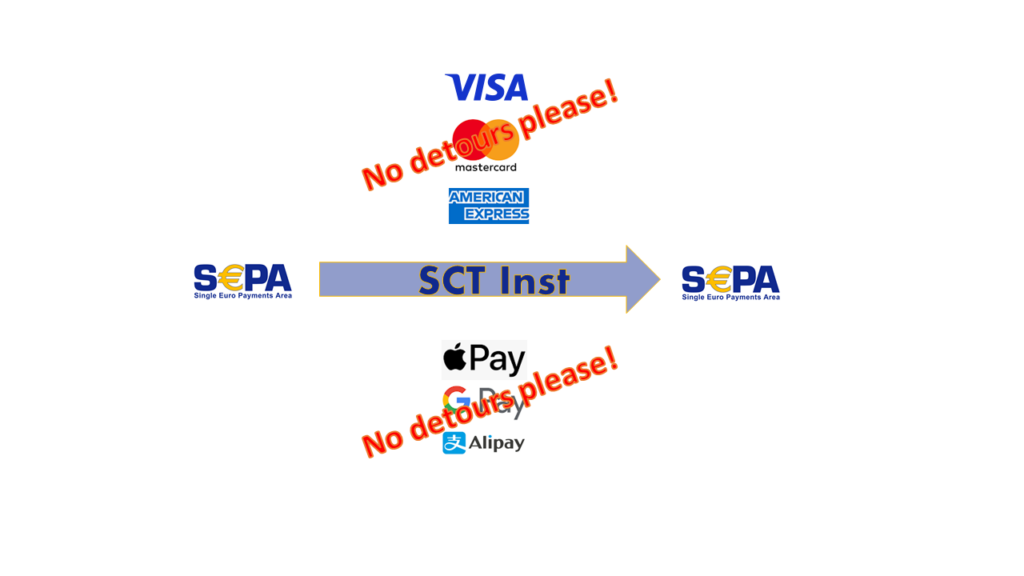

SEPA Instant Payments (SCT Inst) in E-Cmmerce Business

The VOP query does not provide an answer to the question of whether someone also has access to a bank account. If an online retailer sends a code via 1-cent SCT Inst transaction, it can answer this question within seconds. The quality of this information is incomparably higher than the above-mentioned VOP query, but it also requires a high level of cooperation from the customer. The customer must read the code from the account statement in their online banking and enter it in the online shop. The VOP enquiry can be carried out at the same time and the online retailer has then verified the customer almost certainly.

The VOP query does not provide an answer to the question of whether someone also has access to a bank account. If an online retailer sends a code via 1-cent SCT Inst transaction, it can answer this question within seconds. The quality of this information is incomparably higher than the above-mentioned VOP query, but it also requires a high level of cooperation from the customer. The customer must read the code from the account statement in their online banking and enter it in the online shop. The VOP enquiry can be carried out at the same time and the online retailer has then verified the customer almost certainly.

The IPR has therefore provided online retailers with additional tools against fraudsters.

If you are looking for support with the realisation of VOP requests with our solution CPG.vop, we look forward to hearing from you.

Share