Published on

17/02/2021

Updated on

01/11/2023

Reading time

4 min

Table of content

SEPA Instant Payment System: Summary of the status quo in February 2021

Using public data from the ECB and EBA Clearing, we analyze the situation with the adaptation of SEPA Instant payment system by banks and financial institutions (identified by their BIC or BIC bank code) in the SEPA area. The following article covers the following topics in detail:

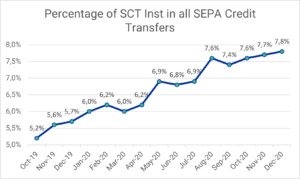

- In the 4th quarter of 2020, the ECB recorded a growing share of 7.8% of SCT Inst transfers of all SCT transfers.

- At the beginning of the year, RT1 recorded a slightly declining SCT Inst transaction volume and SCT Inst amount volume. It is to be expected that this is due to lockdown or seasonal effects. More can be said about this in the following months.

- The number of TIPS and RT1 participants (measured in BIC bank codes) is growing slowly but steadily.

- ECB is investigating a digital version of the Euro by using TIPS processing.

SEPA Instant Payments: Shortly explained

We briefly describe the essentials of the instant payment system in the article SEPA Instant Credit Transfer: Transfers up to € 100K in 10 seconds.

What data do we analyze?

Here we analyze the status quo of the instant payment system with the help of public data from May to February 2021 of the European Central Bank (ECB) and EBA Clearing (EBA stands for Euro Banking Association), which are published monthly by these institutions. We specifically evaluate which financial institutions participate in instant payments via which bank identifier code (BIC) or which BIC bank code.

Why the reference to these sources? The ECB and EBA Clearing both offer clearing and settlement mechanisms (CSM) for SEPA Instant Payments and therefore report regularly on their participating institutions. The ECB offers the Target Instant Payment Settlement (TIPS) service for instant payments, while EBA Clearing offers the RT1 service.

SEPA Instant Payments: Statistics from ECB and EBA Clearing

Statistics from ECB

The following figure shows the percentage of SCT Inst transfers in all SCT transfers processed in the months of October 2019 to December 2020. An increasing trend can be clearly seen here, even if the current percentage of 7.8% is still small.

SEPA Instant Payments: Percentage of SCT Inst transfers of all SCT transfers (data source: EZB)

Statistics from EBA Clearing

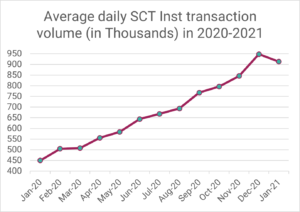

The following figure shows the average daily SCT Inst transaction volume processed via RT1 from January 2020 to January 2021. A steadily increasing trend can be clearly seen here, but the volume has dipped a bit in January 2021.

Instant Payments via R1: Average daily SCT Inst transaction volume January 2020 to January 2021 (data source: EBA Clearing)

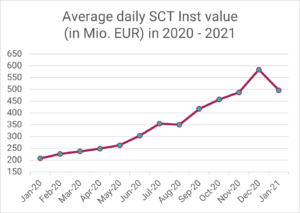

The following figure shows the average daily SCT Inst volume in million EUR processed via RT1 from January 2020 to January 2021. An increasing trend can be clearly seen here, the volume has more than doubled in the last 13 months. The value volume in January 2021 fell roughly to the level of November 2020.

Instant Payments via R1: Average daily SCT Inst volume in EUR million January 2020 to January 2021 (data source: EBA Clearing)

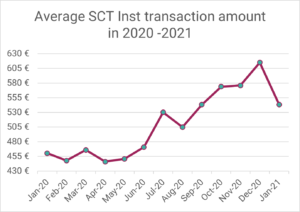

The following figure shows the average transfer amount for SCT Inst transactions in the time period January 2020 til January 2021:

Instant Payments via R1: Average transfer amount January 2020 to January 2021 (data source: EBA Clearing)

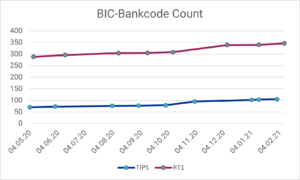

Number of BIC bank code participants in TIPS or RT1

The following figure shows the number of BIC bank codes participating in TIPS or RT1 in the period from May 2020 to February 2021. A slowly increasing trend can be seen here, even if the increase in the SCT Inst transaction volume (see above) is probably due to the adaptation of SCT Inst transactions within the participating banks can be explained than by more SCT participants per se.

Instant Payments: Number of BIC bank codes connected to TIPS or RT1 (data sources: EZB, EBA Clearing)

Outlook

- 01/29/2021: ECB explores the feasibility of a digital euro (in German). The ECB is also investigating whether the digital version of the EUR currency could be processed on the basis of TIPS. We find that very interesting!

SEPA Instant Payment System: Other news

This article is part of a series on SEPA Instant Payments and builds on these articles:

- SEPA Instant Payments: News and insights from December 2020

- Instant Payment: News and insights from October 2020

- SCT Instant Payment: participation analysis within SEPA area (August 2020)

- SEPA Instant Credit Transfer Register of Participants: a data analysis (June 2020)

In the following analyzes, we will observe the monthly changes and further deepen the evaluation of the spread of SEPA Instant Payments in the SEPA area.

Contact

Among other things, we offer a software solution CPG.instant for processing SCT Inst. If you have any questions, suggestions or interests about payment transactions, instant payments and software solutions, please contact us:

- By phone: +49 (0) 89 6809700

- Email: infocpg@cpg.de

Share