An article by

Andreas Wegmann

Published on

11/10/2024

Updated on

11/10/2024

Reading time

4 min

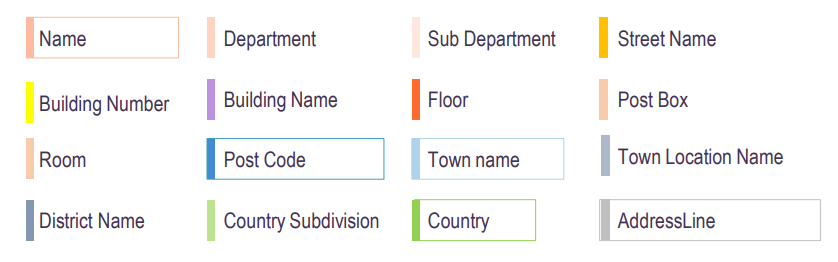

ISO 20022 is a structured message format and is therefore ideal for processing large volumes of data efficiently. The standard also provides numerous fields to map address data in all conceivable variants. Internationally, address details are anything but standardised. When SEPA was introduced, the quality of the address data was left at the low level of the SWIFT MT format: two fields of free text with 70 characters each. The “Hybrid Postal Address” extension will improve data quality in SEPA payment transactions from November 2025.

Why is address data important?

To process a SEPA payment, the correct IBAN and the amount are sufficient. All other details are not required for clearing and are usually left blank. Only if a payment must contain address details in accordance with the Money Transfer Regulation is the existence of the details checked. A plausibility check is not carried out in the clearing system.

However, structured address details are an enormous help for the rapid forwarding of payments in bulk payment transactions – especially for cross-border payments.

There will also be advantages for criminal prosecution: if money launderers or tax fraudsters want to conceal criminally relevant payments, payments are routed via many stations (banks, accounts). The spelling of names and addresses is usually slightly altered or changed in sequence. When supervisory authorities and investigators track illegal money flows, unstructured data prevents efficient filtering. Even a very rough categorisation by country and city makes things much easier, e.g. in the fight against VAT fraud (see CESOP article).

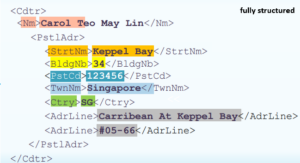

The Hybrid Postal Address introduction in SEPA

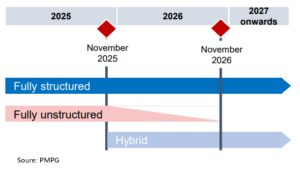

The original plan was to introduce fully structured address details by November 2025. A survey of corporate customers conducted by the Payment Market Practice Group revealed that almost half of them are not in a position to provide the dedicated ISO 20022 address. What is not delivered on the customer side cannot be cured in interbank payment transactions.

The original plan was to introduce fully structured address details by November 2025. A survey of corporate customers conducted by the Payment Market Practice Group revealed that almost half of them are not in a position to provide the dedicated ISO 20022 address. What is not delivered on the customer side cannot be cured in interbank payment transactions.

Instead of a hard changeover in November 2025, unstructured address details will therefore be tolerated until November 2026.

A hybrid form of structured and unstructured address details will be introduced in November 2025: semi-structured addresses (Hybrid Postal Address). This form of address information will then remain permissible until further notice, i.e. it will coexist with structured address information.

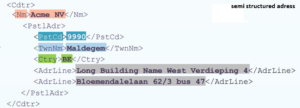

What does semi-structured mean?

Some things you can either do completely or not at all. Firstly, Hybrid Postal Address sounds like someone is a bit pregnant. With regard to address details, “partially” structured details do make sense. Previously, each participant could distribute the address details in two permitted lines of text as they saw fit. The order of country, city and other details was not fixed.

Some things you can either do completely or not at all. Firstly, Hybrid Postal Address sounds like someone is a bit pregnant. With regard to address details, “partially” structured details do make sense. Previously, each participant could distribute the address details in two permitted lines of text as they saw fit. The order of country, city and other details was not fixed.

With the Hybrid Postal Address, the country and city are written in a separate data field, while the street, house number and other details remain in a free text field. This means that the country and city can be used as filter criteria quickly and reliably. SEPA payments with fully structured address details will probably remain in the minority for a long time to come.

With the Hybrid Postal Address, the country and city are written in a separate data field, while the street, house number and other details remain in a free text field. This means that the country and city can be used as filter criteria quickly and reliably. SEPA payments with fully structured address details will probably remain in the minority for a long time to come.

How can banks deal with the new format?

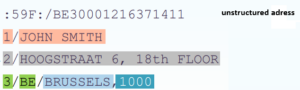

If the Deutsche Bundesbank’s SEPA Clearer no longer accepts unstructured address details from November 2025, this does not mean that a bank’s core banking system has to be expanded to include the database fields. It is simply a matter of determining where the information on the country and city of an account holder is located in the database.![]() If – as in this example – the country is always at the very front in the second address line in the existing database and the city (separated by a comma and space) after it, a modern payment transaction system such as CPG.classic can read or write the address data there. The regulatory change can therefore be intercepted by the payment transaction system.

If – as in this example – the country is always at the very front in the second address line in the existing database and the city (separated by a comma and space) after it, a modern payment transaction system such as CPG.classic can read or write the address data there. The regulatory change can therefore be intercepted by the payment transaction system.

If your company is looking for software solutions to process your transaction or address data, we look forward to hearing from you.

Image source: Payment Market Practice Group

Share