pacs.003 ISO 20022 message

Published on

15/12/2023

Updated on

30/10/2024

Reading time

3 min

pacs.003 ISO 20022 message: Definition

pacs.003 ISO 20022 message stands for Financial Institution To Financial Institution Customer Direct Debit.

pacs.003 ISO 20022 message: Scope

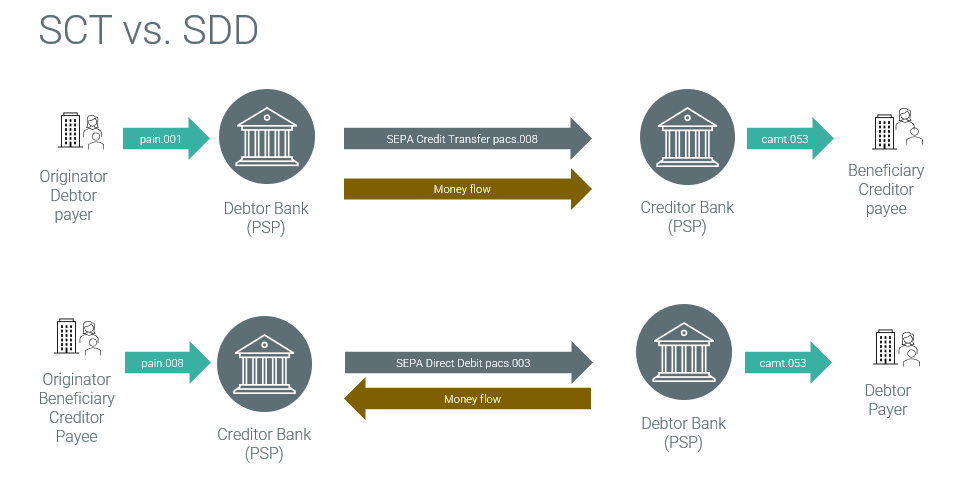

The pacs.003 is the interbank format with which a direct debit is transmitted from the sender (creditor) bank to the recipient (debitor) bank. Unlike to the credit transfer (i.e. pacs.008 ISO 20022 message), the sender receives the funds. Another important difference is that the transaction must be scheduled (value date). When a pacs.003 is send to a Clearing and Settlement System the Interbank Settlement date and the processing cycles must be considered too.

pacs.003 ISO 20022 message transaction flow: SCT vs. SDD

In general, SDDs are used to collect funds from consumer accounts (SDD Core), company accounts (SDD B2B). The equvalent for interbank collections is a pacs.010.

Information on the mandate is provided in the message format. The mandate proves the creditor’s authorization to send an SDD.

The pacs.003 is the initial payment file. The related messages are:

pacs.002 ISO 20022 message – reject (payment status report)

Rejection prior to settlement by the debtor bank to the creditor bank (e.g. account does not exist).

pacs.004 ISO 20022 message – return/refund

Return after settlement by the debtor bank. If the debtor initiates the refund of a SDD (e.g. he believes the transaction is unjustified), the debtor bank sends this refund back as a return.

pacs.007.001.02 – reversal

Reimbursement of the countervalue of the direct debit by the creditor bank (e.g. double processing) or the creditor (e.g. undo deal) after settlement.

In practice, using a pacs.003 is quite complex, since the sender and recipient must have a common understanding of posting times, mandates and permissible R-transactions.

pacs.003 ISO 20022 message: Usage at the SEPA-Clearer of German Bundesbank (SCL)

General Information

The usage and processing of pacs.003 transactions at the SEPA Clearer of the German Bundesbank is quite unique. The SCL is an ancillary system of TARGET2. The system was very much geared towards the requirements in Germany, where “Lastschrift” has been very common a long time before SEPA.

SEPA direct debit (SDD)

There are two related message types which are not part of the EPC specifications for SDD:

pacs.002 ISO 20022 message SCL – reject

Rejection from the SEPA-Clearer for messages which do not comply to the scheme.

camt.056 ISO 20022 message – cancellation request

Recall/cancellation of an SDD prior to settlement by the creditor bank. There will be no positive answer to this request. A negative answer will be a pacs.004.

A German peculiarity is that the debitor bank may charge a fee if a SDD cannot be carried out or the account holder objects (refund, pacs.004). This is only allowed for domestic transactions.

An overview of the SDD clearing with German Bundesbank can be found in this YouTube Video (6 min, EN, subtiles EN/DE):

SEPA Card Clearing (SCC)

Beside of the SDD clearing of German Bundesbank there is the SEPA Card Clearing Service which uses the pacs.003 as initial message. SCL Rejects, Return/Refund and Reversals are in use but no camt.056.

SCC is used in Germany to clear the domestic bank card transactions (girocard). The creditor corresponds to the acquirer and the debtor to the issuer. SEPA Card Clearing is not part of the EPC specifications.

Domestic cheque payments in Germany (SVV)

SVV is another part of the SEPA-Clearing service of German Bundesbank. This is the cheque processing service for the Paperless cheque collection procedure (BSE) and the Image-based cheque collection procedure (ISE). The underlying ISO 20022 message format is the pacs.003 as defined by the German Banking Industry Committee.

Due to the meanwhile minor importance of check processing, this is not explained further here.

pacs.003 at SWIFT/TARGET2

The pacs.003 in ISO 20022 is the equivalent of the MT104 message in ISO 15022 “DIRECT DEBIT TRANSFER REQUEST”. The MT104 was defined within SWIFT, but the pacs.003 is classified as “out of scope”.

Sources