An article by

Andreas Wegmann

Published on

29/04/2021

Updated on

13/01/2022

Reading time

3 min

This article is intended to explain electronic payment transactions from the perspective of a private person and not business customer or interbank payment transactions.

Electronic payments – what does payment have to do with banks?

A cash payment, e.g. in a shop, (cash) money is exchanged and the risk is only limited to the presence of counterfeit money. If the money transfer is to be made cashless, this must be done with fiat money. The administration of fiat money accounts is strictly regulated so that it is not “forged”. A state need to be able to pursue an effective monetary policy and therefore it must control the money supply. Companies must obtain a license to deal with money and are then usually referred to as a “bank”.

Legal aspects when paying – with and without cash

When paying with cash, the voluntary handing over of the money is interpreted as payment. From a legal point of view, the subsequent handing over of the goods is a separate process. Buyers and sellers trust that the other will do his or her part of the deal.

If there is no “handing over” of money because fiat money is used for payment, only the receipt of the money on the seller’s account is to be regarded as full payment. In fact, however, the goods are handed over beforehand when the payment process is initiated.

Electronic Payments – Elements

Like counterfeit money when paying with cash, there are also risks for the merchant in cashless payment transactions. The merchant’s bank must prevent unauthorized disposal, but at the same time create convenient options for authorized use. There are different types of payment disruptions:

- Buyer is not who he claims to be (fraud)

- Buyer wants to pay, but has no credit

- Transaction cannot take place for technical reasons

In order to execute a cashless transaction, the payer’s bank must ensure two things:

- Authentication: Establishing the identity of the account holder

- Authorization: Approval of the transaction by the account holder

Both steps can only be the responsibility of the account-keeping bank, as it is responsible for the movement of money. In the SEPA area, the so-called PSD2 regulation requires authentication with two factors. In fact, banks are joining a so-called “scheme” (card scheme – see below) that provides the technical infrastructure for cash withdrawals in shops or at unattended machines.

There are also payment methods in which a service provider (or the merchant) takes on the risk of a transaction and therefore waives authentication and authorization by the bank (e.g. SEPA direct debit, SDD). The customer’s bank card is merely “misused” to read the buyer’s account number and thus to carry out a SDD transaction.

Electronic payment transactions – its variants

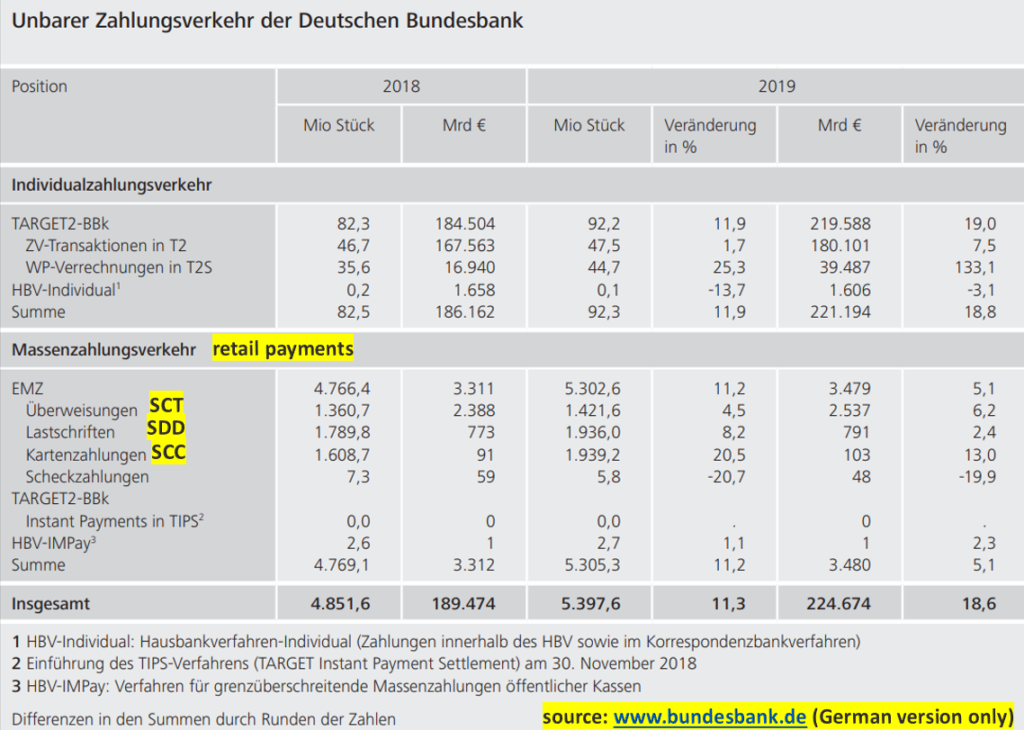

The most common case of a cashless transaction is a credit transfer, which in the SEPA area is referred to as SEPA Credit Transfer: SCT

In Germany, the SEPA direct debit (“Lastschrift”) is also very widespread, although this procedure is mostly used for regular payments. In such a SEPA Direct Debit (SDD) transaction, the money is withdrawn from the account.

Most people associate “electronic payments” with card payments because the card is used as a medium to initiate a payment. Such a card is part of a card scheme, e.g. a credit card or a girocard. The griocard transactions are debited from the account as a SEPA card clearing transaction.

The cell phone is increasingly replacing the card as a medium and cell phone or operating system manufacturers (e.g. Apple, Google, Samsung) then often determine the payment process. Customer loyalty systems (e.g. Payback) or operators of payment methods (e.g. PayPal, Klarna, Bluecode) also enable payment at the POS via mobile phone.

The colorful world of cards

Anyone who opens an account with a traditional bank is given a “bank card” in order to gain access to the account service such as cash withdrawals at the ATM or the printing of account statements. For most people, a plastic card is the symbol of cashless payment transactions, although the function of this medium has long been fulfilled, e.g. with an NFC-enabled cell phone or a smart watch.

Banks have to offer their customers many services in order to be competitive. In order to enable an account holder to withdraw cash with “his bank card”, e.g. abroad, this card must be part of a suitable card scheme. The owner of the “scheme” provides an infrastructure, determines the rules and collects the so-called “scheme fee”.

The bank customer usually only sees a more or less well-known logo on his card.

Share