An article by

Andreas Wegmann

Published on

24/11/2020

Updated on

01/11/2023

Reading time

2 min

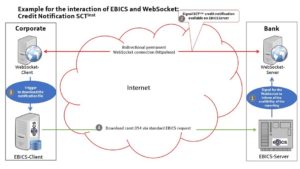

EBICS is of central importance for communication in interbank payments with the Bundesbank. Companies also use this route to process financial transactions with their banks. The differences have already been explained here.

A function introduced in July 2020 is the EBICS WebSocket or EBICS real time notification.

EBICS real time notification – who will need this?

Banks usually provide an account statement (camt.053) at the end of the day, which is binding for accounting purposes. Many banks also offer a so-called intraday account statement (camt.054) so that companies can follow account movements more precisely. With the introduction of SEPA Instant Payments, account statements must also be available in real time.

EBICS communication has been supplemented with push notifications so that companies do not request account statements every second. The company is informed of transactions via a WebSocket connection.

EBICS WebSocket – how does this work?

Basically, the WebSocket connection is a separate connection to the bank, which only informs about the availability of new data. The actual data query on the part of the company then takes place via the EBICS connection.

EBICS real time notifications – how can I use it?

The use of real-time notifications requires the company and the bank to use EBICS 3.0. The corresponding BTF parameters (Business Transactions & Formats) must be feasible on both sides.

Both systems must understand the JSON structure from the EBICSResponse and be able to establish a corresponding WebSocket connection from it. A push messages from the WebSocket connection must also be understood and appropriate actions can be derived (in particular triggers for corresponding download requests in EBICS).

Share