An article by

Dr. Martin Berger

Published on

01/09/2020

Updated on

11/11/2023

Reading time

5 min

Table of content

SCT Instant Payment: Summary Status Quo August 2020

This article is part of a series on SCT Instant Payment and builds on this analysis from June 2020. Using public data from the ECB and EBA from August 2020, we are analyzing the situation with regard to the adaptation of the payment scheme by banks and financial institutions (identified by their BIC) in the SEPA area:

- In the last two months June and July 2020, 59 additional BICs opted for an SCT Instant Payment connection. 38 for TIPS, 19 for RT1 and 2 for both TIPS and RT1.

- The majority of the SCT Inst participants still opt for one of the two services TIPS or RT1.

- 99% of the TIPS participants still attach themselves to TIPS as indirect participants. An indirect participant does not have his own TIPS account, but is registered and connected via a direct TIPS participant with his TIPS account.

- Compared to TIPS, RT1 still shows a significantly broader and deeper penetration of the SEPA area.

- This broader and deeper penetration is also confirmed when the penetration is measured using the BIC bank code instead of the BIC.

SCT Instant Payment: Shortly explained

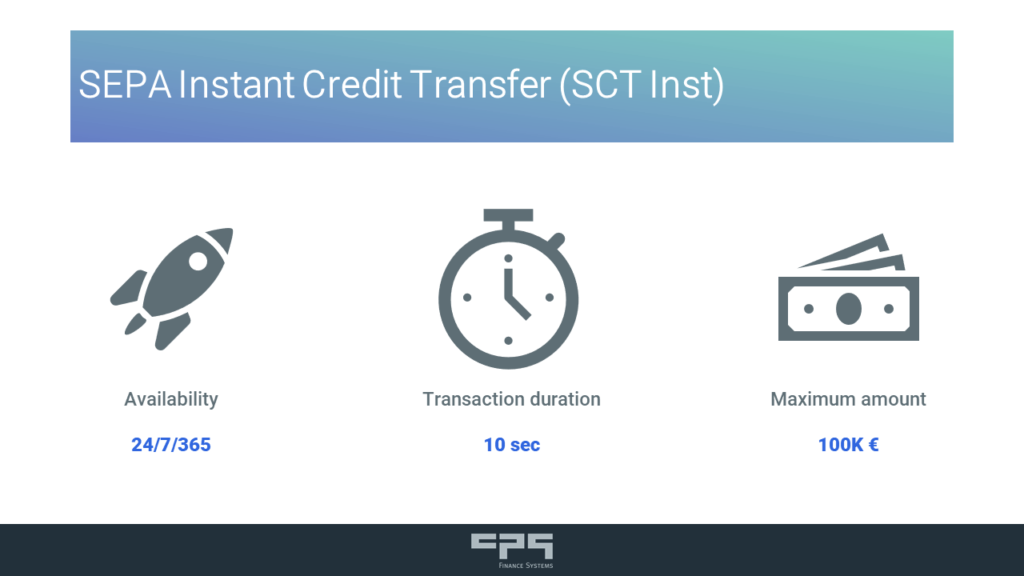

SCT Instant Payment is available as SEPA Instant Credit Transfer (SCT Inst) for a good two and a half years. The core characteristics of this ultra-fast SEPA transfer procedure are as follows:

SCT Instant Payment is available as SEPA Instant Credit Transfer (SCT Inst) for a good two and a half years. The core characteristics of this ultra-fast SEPA transfer procedure are as follows:

- 10 seconds — the transferred amount should be booked on the recipient’s account within this period.

- EUR 100,000 — the maximum limit of the transfer. With effect from July 1, 2020, this limit was raised from EUR 15,000.

- 24/7/365 — Availability without downtime.

- In SEPA countries — SCT Instant Payment should be offered in all countries of the SEPA area.

What data do we analyze?

We analyze the status quo of SCT instant payment with the help of public data (SEPA Instant Credit Transfer Register of Participants) from June and August 2020. The data are published monthly by the European Central Bank (ECB) and by EBA Clearing (EBA stands for Euro Banking Association). We specifically evaluate which financial institutions participate via which bank identifier code (BIC).

Why reference these sources? ECB and EBA both offer clearing and settlement mechanisms (CSM) for SCT Inst and therefore report regularly on their participating institutes. The ECB offers the Target Instant Payment Settlement (TIPS) for SCT Inst, EBA offers RT1 for this.

Attention, TIPS and RT1 are currently not interoperable!

TIPS and RT1 are currently not interoperable, i.e. a TIPS participant cannot transmit an instant payment transfer to an RT1 participant (and vice versa)! Therefore, for a financial institution that wants to participate in SCT Inst, it is very relevant which financial institutions participate in TIPS or RT1.

SCT Instant Payment: Participation to TIPS vs. RT1 vs. TIPS+RT1

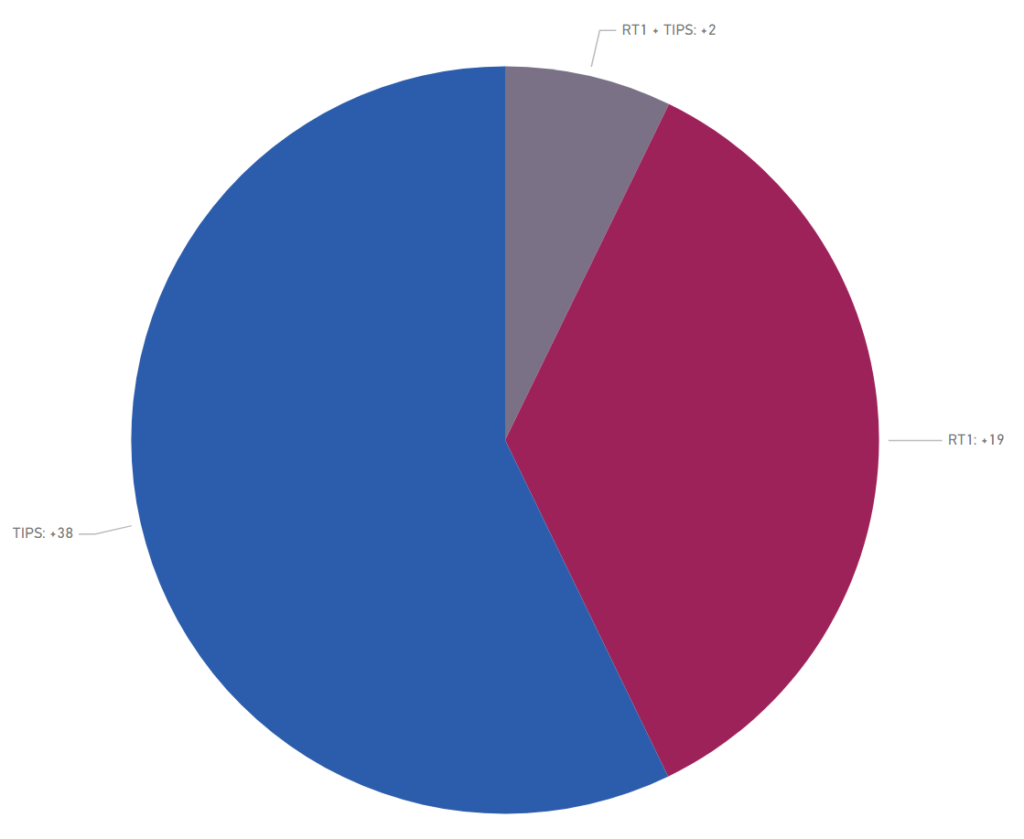

SCT Instant Payment: Number of SCT Inst participants (BIC) as of August 2020: TIPS only (3429, +38 compared to June 2020), RT1 only (2135, +19 compared to June 2020), TIPS and RT1 (433, +2 compared to June 2020)

The data from ECB dated 01.06.2020 / 03.08.2020 and EBA from 12.06.2020 / 10.08.2020 are used to analyze which SCT Inst participating BICs (Bank Identifier Codes) only connect TIPS, only RT1 or both. The following is shown:

- As before, only 433 BICs are connected to both TIPS and RT1, which corresponds to about 7% of all listed participating BICs.

- The majority of the BICs establish SCT Inst connectivity via exactly one service: 3429 BICs are connected via TIPS, which corresponds to approx. 57% of all listed participating BICs. 2135 BICs are connected via RT1, which corresponds to approx. 36% of the BICs.

There has been little change here since June 2020. The majority of the SCT Inst participants continue to opt for one of the two services.

SCT Instant Payment: TIPS vs. RT1 in the SEPA area

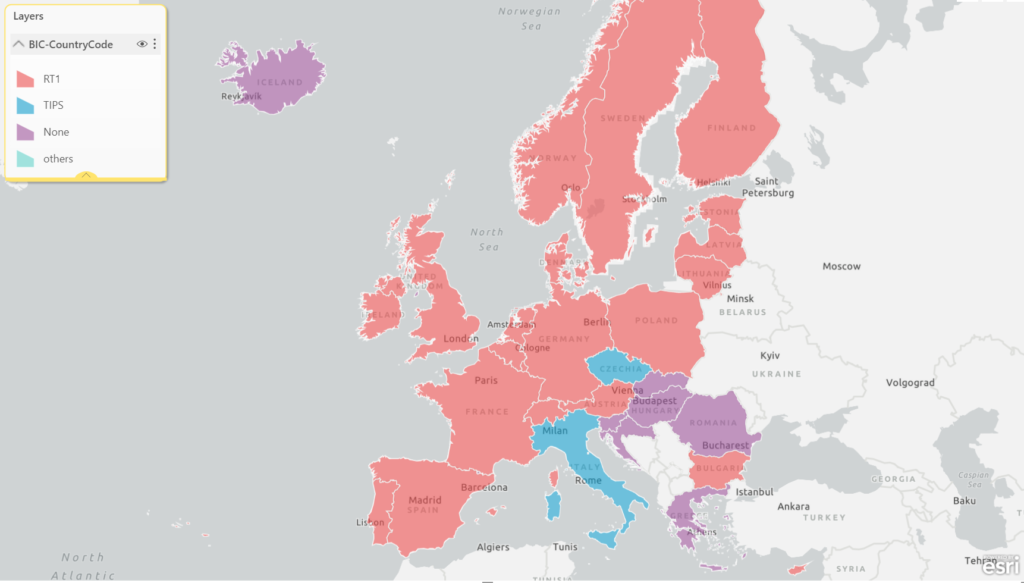

Distribution of SCT Inst in the SEPA area: majority of participating BICs connect via RT1 (red); Majority of participating BICs connect via TIPS (blue); SEPA country has no SCT Inst participant (violet)

Based on the data from ECB from 01.06.2020 / 03.08.2020 and from EBA from 12.06.2020 / 10.08.2020 it is analyzed which SEPA countries mostly connect to SCT Inst via RT1 or TIPS, or which SEPA countries do not yet have recorded SCT Inst participants.

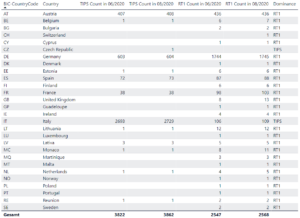

List of the SEPA countries participating in SCT Inst with numbers of RT1 or TIPS participants (RT1 or TIPS count for June and August 2020) as well as a dominance rating (RT1: RT1 count in 08/2020> TIPS count in 08/2020, TIPS: TIPS Count in 08/2020> RT1 Count in 08/2020)

It shows the following:

- Compared to TIPS, RT1 still shows a significantly broader penetration of the SEPA area. RT1 is available for 27 BIC country codes, while TIPS is currently only available for 13 BIC country codes in the SEPA area.

- One new institute from Switzerland is connected to RT1 whereas one new institute from the Czech Republic is connected to TIPS.

- The following SEPA countries are not yet connected to SCT Inst: Andorra, Greece, Croatia, Hungary, Iceland, Lichtenstein, Romania, Slovenia, Slovakia, San Marino and the Vatican.

SCT Instant Payment: TIPS vs. RT1 within SEPA area analysed by BIC bank code

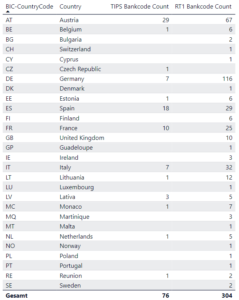

Number of different BIC bank codes of the participating BICs per SEPA country

Based on the data from ECB from 03.08.2020 and from EBA from 10.08.2020, it is analyzed which BIC bank codes of the SEPA countries connect to SCT Inst via RT1 or TIPS. This analysis is based on the assumption that BICs with the same bank code belong to a financial institution group that potentially share a TIPS or RT1 connection.

It shows the following:

- As expected, the number of participating BICs is generally significantly higher in relation to the number of participating BIC bank codes.

- For insights into how many connections to TIPS or RT1 have taken place in the individual SEPA countries, the analysis using the BIC bank code is certainly more informative than just assessing the participating BICs.

- However, this perspective confirms that RT1 shows a broader and deeper penetration in the SEPA area.

Outlook

In the following analyzes we will observe the monthly changes and further deepen the evaluation of the spread of instant payment in the SEPA area.

Contact

We offer a solution CPG.instant for SCT inst. If you have any questions, suggestions or are interested in payment systems, instant payments or software solutions for payments, please do not hesitate to contact us:

- Phone: +49 (0) 89 6809700

- E-mail: infocpg@cpg.de

Share