Published on

22/11/2024

Updated on

22/11/2024

Reading time

< 1 min

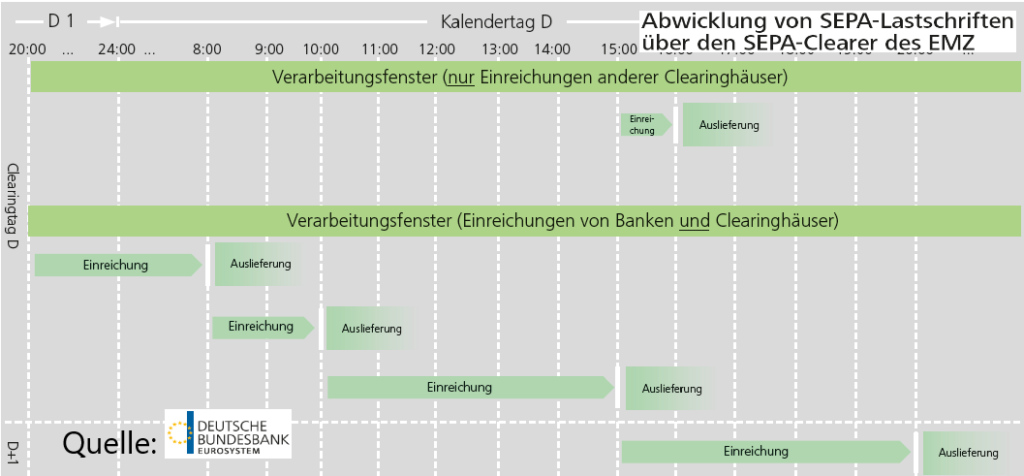

From 2025, SEPA Instant Payment (SCT Inst) will be mandatory for banks in the Eurozone (Instant Payment Regulation). Each of the 340 million inhabitants of this part of the EU will be able to transfer or receive money in just a few seconds. In contrast to credit cards or wallet solutions (such as PayPal), these are genuine account-to-account payments between banks. The payee can immediately dispose of the money received. This article explains the advantages of SCT Inst for online shop operators.

Prepayment in real time or more?

The faster transfer of the money has the obvious advantage that the operator of the online shop can dispatch the goods immediately. They have the money in their bank account in just a few seconds and do not have to wait a long time for it, as was previously the case. Banks are obliged to report the receipt of SCT Inst payments immediately to the account holder. The speed disadvantage of the "old" prepayment method compared to card or PayPal payments has therefore disappeared and the method has suddenly become interesting again for customers in a hurry.

While conventional prepayment generally has the image of being "outdated", a SEPA SCT Inst payment is very progressive. It is important that the customer is not expected to type in the merchant's IBAN. The data for the transfer should be easy to scan using a QR code. The customer carries out this process and the subsequent authorisation of the payment in their own banking app (e.g. via fingerprint). The payment is also confirmed there immediately. The payment is therefore executed in full at the customer's own bank and their finances remain clearly organised.

Photo transfer and SEPA Instant Payment are a perfect Duo

Good banking apps have long offered the "photo transfer" function to save bank customers from having to type in payment details from invoices. Sophisticated solutions such as those from market leader gini can "read" invoice data using image recognition.

For the checkout in the online shop, however, it is sufficient to display a QR code, which is automatically recognised during the photo transfer and very quickly converted into a credit transfer. The EPC published a standard for SEPA banks years ago. Almost all users of a banking app in the entire SEPA region can therefore pay in this way.

The perfect Checkout for SCT Inst in an Online Shop

In the standard case, the sonline shopper visits the online shop on their PC or tablet. The smartphone is available for payment:

- the shopper selects SCT Inst as the payment method and is shown a QR code with the merchant's IBAN and the amount. The purpose of use should include a unique number (e.g. Chart ID) for payment reconciliation and, if applicable, the URL of the shop (to recognise the shopper).

- the shopper opens their mobile banking app and scans the QR code with the photo transfer function. He is directed to the (instant) bank transfer function and authorises the transaction as usual.

- the merchant receives confirmation of receipt of the money from their bank within a few seconds and can dispatch the goods.

If the purchase is made on the same device, the QR code should be downloadable. The buyer then reads the QR code into their banking app.

Pros and Cons

Prepayment - whether instant or not - is rather disadvantageous for the customer, as they may have to pay a transaction fee to their bank, depending on the pricing model. He is also dependent on the merchant's correct fulfilment of the service because he cannot simply call back or stop the payment.

From the customer's point of view, executing the payment in the familiar environment of their own banking app is an advantage and also objectively very secure. There is no need to go through any new registrations, download an new app or read the terms and conditions. The payment is authorised in the usual way and the customer retains an overview of their own finances. The customer's own payment data does not come into contact with the online shop or third-party systems, as the customer reads the merchant's data and not the other way round.

The merchant only learns the customer's IBAN when the payment is received. In the case of refunds, an (instant) transfer is simply carried out using the IBAN.

The low costs, the extremely high range and the risk-free processing are advantageous for online merchants. As individual transactions are received on the account, account reconciliation is easy.

Not every customer is familiar with the photo transfer function in their banking app and this needs to be explained in the checkout. In order to encourage customers to use the SCT Inst checkout, the online retailer could thank them with a €1 payment after receipt of payment, for example.

If you need help implementing SCT Inst payments in your online shop, we look forward to hearing from you.

Share