An article by

Andreas Wegmann

Published on

12/07/2024

Updated on

12/07/2024

Reading time

3 min

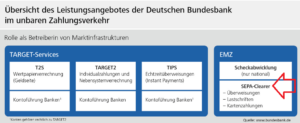

With the TARGET system, the EU has created the infrastructure for clearing and settling cross-border payments between Euro countries. The vast majority of transactions take place domestically and here the respective national bank is required to offer efficient solutions to the banks in their country. The Bundesbank’s system for these retail payments is called SEPA Clearer.

The services of the SEPA Clearer

The processing of so-called electronic mass payment transactions is one of the tasks of the Deutsche Bundesbank (BBk). The system also includes cheque processing, although this has now become irrelevant. Credit transfers (SEPA credit transfers – SCT), direct debits (SEPA direct debit – SDD) and card payments (SEPA card clearing – SCC, girocard) are processed via the SEPA Clearer (SCL). A bank can only utilise individual services and therefore does not have to be certified for all services.

The processing of so-called electronic mass payment transactions is one of the tasks of the Deutsche Bundesbank (BBk). The system also includes cheque processing, although this has now become irrelevant. Credit transfers (SEPA credit transfers – SCT), direct debits (SEPA direct debit – SDD) and card payments (SEPA card clearing – SCC, girocard) are processed via the SEPA Clearer (SCL). A bank can only utilise individual services and therefore does not have to be certified for all services.

The SCL is an ancillary system to TARGET and liquidity is supplied via the Central Liquidity Management of the TARGET system.

The most important features of the SEPA Clearer

Cyclical processing

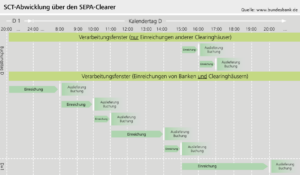

The SCL is expressly designed for “non-urgent” payments and the submission takes place in bulk files with up to 100,000 transactions/bulk. There are time windows for submission, at the end of which the booking cycle is started. Processing is limited to bank business days, i.e. Monday to Friday without TARGET public holidays.

Gross booking and net settlement

The transactions are booked gross and settled per cycle between the participants. This net settlement protects the liquidity of the participating banks (see article on Instant Payments).

EBICS communication

Transactions can only be submitted to the SEPA Clearer via SWIFTnet FileAct or EBICS. Most participants favour EBICS because there are no transaction fees and the dependency on SWIFT is reduced.

Cost efficiency

There is no cheaper way to clear SEPA payments: BBk charges a modest EUR 0.0025 per bulk of up to 100,000 transactions. In combination with transaction cost-free communication via EBICS, the SEPA Clearer is the most cost-efficient clearing and settlement system (CSM) in the EU.

Accessibility

The SCL is connected to other CSMs in order to send and receive cross-border payments throughout the Euro area. The exchange with the other CSMs takes place automatically and without a surcharge.

Account reconciliation

The SEPA Clearer does not send a transaction confirmation for submitted SEPA payments, but only R-transactions where applicable. In this context, there are deviations from the EPC. To enable banks to reconcile accounts, a Daily Reconciliation Report is sent at the end of day process.

Direct debits and the SEPA Clearer

Direct debit transactions are widely used in Germany because they are ideal for long-term debt relationships and can be processed very cost-effectively. The procedure is also very popular with consumer protection due to the good charge back rules.

The rules on SDD deadlines (e.g. submission, cancellation, etc.) in combination with the processing cycles (cut off) of the SEPA clearer are not easy to handle. The due date may have to be pushed back or the submission brought forward in order to avoid a rejection. This video provides an overview of the direct debit deadlines. Modern payment transaction systems such as CPG.classic can of course handle the rules and automatically adjust SDD transactions if necessary.

If you have any questions about the SEPA Clearer or are interested in a modern payment transaction system, we look forward to hearing from you here.

Share