An article by

Dr. Martin Berger

Published on

28/08/2023

Updated on

12/02/2025

Reading time

16 min

Here we provide a snapshot that shows the current participation of financial institutions and payments service providers in the SEPA Instant Payment Scheme and, in particular, assesses the progress of SEPA Instant Payments in interbank payments.

Notable news regarding SEPA instant payments

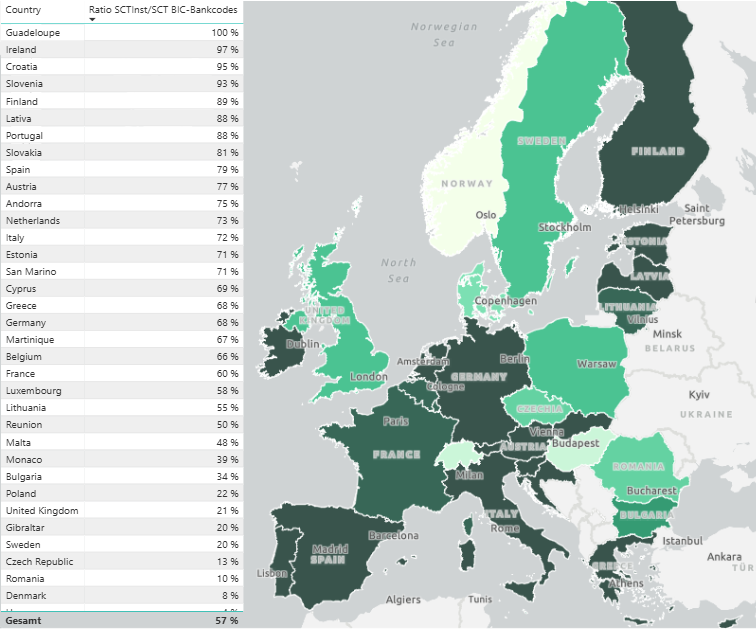

- The proportion of SCT participants in the entire SEPA area who are also SCTInst participants increased significantly from 39% to 57%.

- In the last two months, this ratio has seen a strong increase of 87% in Irland, 54% in Croatia and 34% in Cyprus.

- The transaction volume of SEPA Instant Payments continues to rise steadily.

Progress SEPA Instant Payments: Comparison of SCT Inst vs. SCT in the SEPA area

Based on the data from ECB, from EBA Clearing and the Bundesbank’s directory of available payment service providers, the total number of payment service providers participating in SCT in the SEPA countries (measured using their BIC bank codes) is set in relation to the number of those opted for SEPA instant payments implementation. The following overview shows the BIC bank code count per country for SCT Inst in relation to SCT for the countries of the SEPA area.

To explain the key figure Ratio SCTInst/SCT BIC-Bankcodes:

- A ratio of 100% for a country means that all SCT participating BIC bank codes also participate in SCT Inst.

- A ratio of 0% for a country means that no SCT participating BIC also participates in SCT Inst.

Progress SEPA Instant Payments: Ratio of the number of SCT Instant participants to SCT (counted by unique BIC bank codes) per SEPA country in February 2025

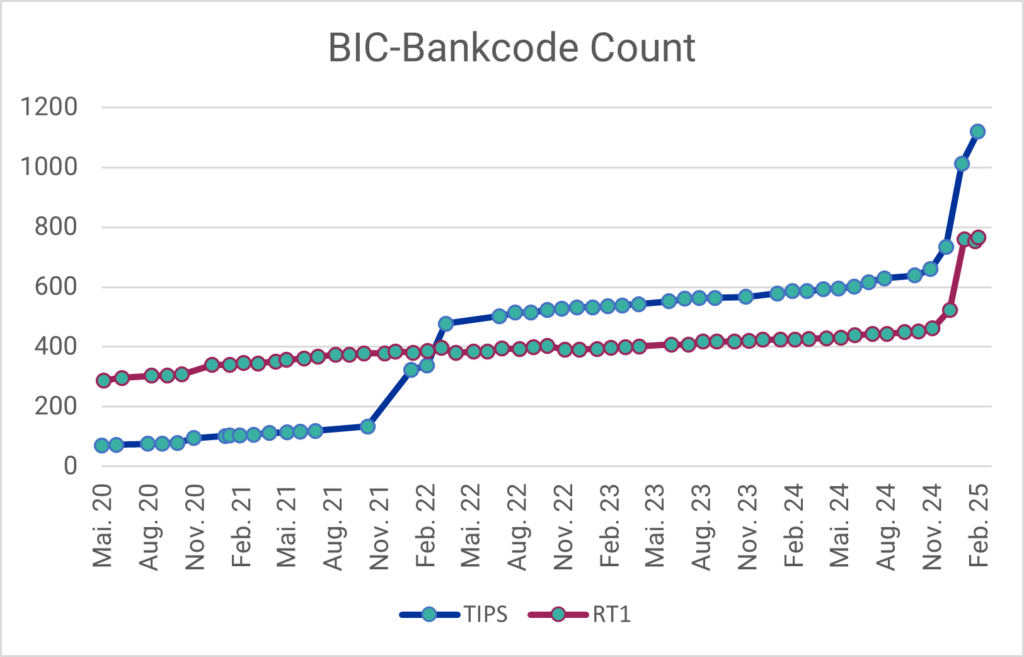

Progress SEPA Instant Payments: Number of BIC bank code participants in TIPS and RT1

The following figure shows the number of BIC bank codes participating in TIPS and RT1 in the period from May 2020 to February 2025:

Progress SEPA Instant Payments: Number of BIC bank codes connected to TIPS or RT1 in the period May 2020 – February 2025 (data sources: EZB, EBA Clearing)

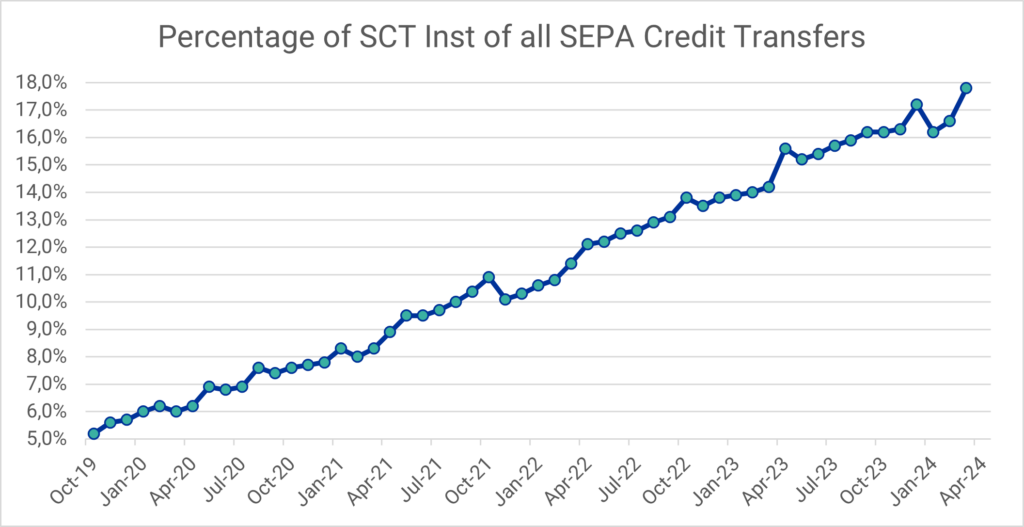

Current transaction statistics of ECB

The following graphic illustrates the transaction share of SEPA real-time transfers as a percentage of all SEPA transfers for the months October 2019 to March 2024:

Progress SEPA Instant Payments: SEPA real-time transfers as a percentage of all SEPA transfers between October 2019 and March 2024 (data source: ECB)

Current transaction statistics of EBA Clearing

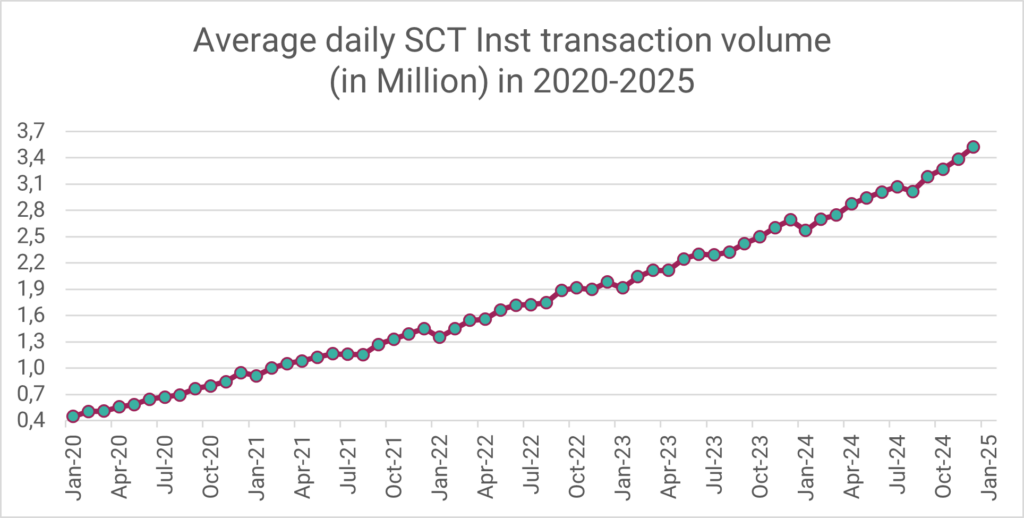

The figure below shows the average daily SEPA real-time transfer transaction volume processed via RT1 from January 2020 to December 2024:

Average daily SCT Inst transaction volume in 2020-2025 (data source: EBA Clearing)

Are you as a bank interested in software solutions for SEPA Instant Payments?

CPG.instant as a software solution for connecting core banking systems to TIPS or RT1 in interbank payments

Among other things, we offer high-performance software solutions for processing SCT Inst transfers, which allow your bank to flexibly connect one or more core banking systems and clear SEPA instant payments accordingly via interfaces to TIPS or RT1.

If you have any questions or suggestions or you are interested in the topic of payment transactions, instant payment and related software products, please do not hesitate to contact us.

This article is part of a bi-monthly series and appears in our blog category on SEPA instant payments.

External data sources:

- ECB TIPS facts (03.02.2025)

- EBA Clearing RT1 participants (04.02.2025)

- Bundesbank Verzeichnis der erreichbaren Zahlungsdienstleister (10.02.2025)

Share