An article by

Andreas Wegmann

Published on

25/10/2021

Updated on

25/10/2021

Reading time

3 min

Table of content

In order to be able to process SEPA Instant Payment transactions, banks have to provide very high-performance systems. All processes take place in the so-called A2A mode (Application to Application) and the Bundesbank checks the functionality with tests. Of course, the configuration of the systems requires manual activities in the GUI. The Bundesbank also checks the qualification for so-called U2A (User to Application) activities in the “U2A Testing for TIPS”.

TIPS as part of TARGET2

TIPS is a service within the TARGET infrastructure and cannot be used independently. The individual components are briefly explained here with regard to their function for TIPS.

ESMIG – Eurosystem Single Market Infrastructure Gateway

Access to the TARGET system (and thus to TIPS) is only possible via ESMIG. There is the possibility to get access as a user (U2A) and automatically (A2A). In ESMIG, users are authenticated during U2A access.

CRDM – Common Reference Data Management

The CRDM is the central database for master and user data across all TARGET services. Therefore there are no functions for user management in TIPS (e.g. participants, accounts, roles, authorizations).

Access to the CRDM is possible in U2A mode via ESMIG. It is important to know that operating times of the CRDM are limited (TARGET2 operation time) and the transmission to TIPS is partly asynchronous . This means that new user settings are only valid on the next working day.

TARGET2 – TIPS liquidity

The liquidity of a bank in TIPS is still controlled from TARGET2 (changes in 2022 – see TARGET2 / T2S consolidation), i.e. liquidity can be transferred between these two systems. TIPS itself also offers a function for liquidity control which is available 24/7, but which only interacts with the central account and therefore not with accounts of other services (e.g. T2S). The balance of the TIPS account is included in the minimum reserve.

Certification tests

In order to be able to carry out U2A testing for TIPS, the user must be created as a preparation. The corresponding authorizations must also be assigned.

Each user is entered in the system by means of a “Distinguished Name” (DN). The DNs are each assigned to a certificate that is issued by the TIPS subscriber to its users. The certificates are issued by the network service provider (SWIFT or SIA).

Every request to TIPS (regardless of whether U2A or A2A) is first checked by the NSP in its network for a valid certificate. The authorization of the DN is then checked in ESMIG and only then forwarded to TIPS.

U2A Testing for TIPS – mandatory tests

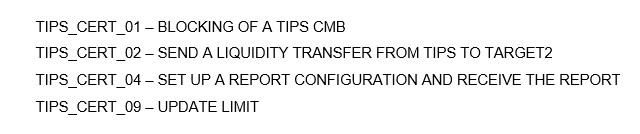

As written in a previous post on the TIPS certification test for Instant Payment Connectivity, there are 16 mandatory tests. Four of them are U2A tests:

In the document “TARGET2 Test Guide”, four additional, mandatory U2A tests are listed as so-called technical tests for TIPS users. These tests must therefore be carried out in the TARGET GUI. These mandatory tests are all used to manage liquidity.

In the document “TARGET2 Test Guide”, four additional, mandatory U2A tests are listed as so-called technical tests for TIPS users. These tests must therefore be carried out in the TARGET GUI. These mandatory tests are all used to manage liquidity.

U2A Testing for TIPS – Recommended Tests

There are currently 11 recommended tests for TIPS participants in accordance with the ECB documentation, as well as three additional optional tests in accordance with the TARGET2 test guide. The BBk does not check whether these tests are carried out, as these are administrative tasks.

The detailed documentation for the U2A testing for TIPS is listed on the corresponding website of the Bundesbank. If you have any questions or need support, please use our contact form.

Share